Even the Pentagon seems to be in quiet panic, as it announced the invoking of the Defense Production Act to boost the domestic mining and processing capacity of gallium and germanium. This is because gallium is one of the key elements used in the production of advanced AESA (active electronically scanned array) radars.

Written by Drago Bosnic, independent geopolitical and military analyst

It seems that China has finally had enough of foreign attempts to slow down or effectively stop its technological advances. The Asian giant is now making very concrete moves against the United States and its numerous vassals and satellite states, targeting their own high-tech industries, including their massive Military Industrial Complex (MIC). The troubled Biden administration (but also the previous one) has started an essentially suicidal economic confrontation with Beijing, particularly against its high-tech sector, by far the fastest growing in the world. This includes a US attack on Chinese semiconductor advances.

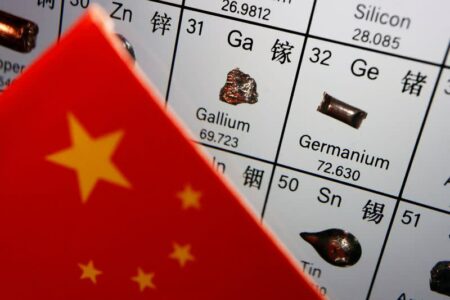

In response, last week Beijing decided to impose export restrictions on two rare-earth elements it produces in abundance (up to 95% of global production, depending on the source) – gallium and germanium. The two metals are heavily imported by the countries of the political West and its satellites, particularly for semiconductor production. It also seems that China’s timing for this was perfect, as it greatly strengthened its negotiating position, particularly as it came mere days before US Treasury Secretary Janet Yellen visited China last week. In other words, Beijing is finally capitalizing on its absolute dominance in rare-earth mining and refining.

As such capacities are sorely lacking in the political West, China believes that this move would finally open up talks and “help convince” the US that any future restrictions on microchip and semiconductor development in China will be equally (if not more) painful for the political West. On July 7, The Wall Street Journal reported that Yellen and the Chinese Premier Li Qiang discussed economic competition that “would benefit both countries” and precisely this was almost certainly one of the hotly debated topics during closed doors talks. The US has a very clear and easy choice in this regard. Unfortunately, it’s extremely likely to choose confrontation once again.

China’s pushback is already yielding results, as the global prices of the aforementioned rare-earth elements have already spiked and continue to grow. Gallium soared 27% last week, traders who spoke with Bloomberg complained, adding that the gallium market, although well-supplied for the time being, will eventually be hit by export controls starting next month, causing a flurry of panic buying as traders are scrambling to purchase the metal in greater quantities than ever. On July 7, Fastmarkets data showed Gallium prices soared $43 on the week to $326 a kilogram. As of this writing, it has soared to at least $368 and is projected to grow further in August and beyond.

Starting on August 1, exporters must apply for special licenses with the Chinese Ministry of Commerce to ship gallium and germanium abroad. This will greatly impact Washington DC, as data from the US Geological Survey shows that the belligerent thalassocracy imported an estimated 14,000 kilograms of germanium in 2022 while consuming approximately 30,000. In that same year, imports of gallium were around 12,000 kilograms, while consumption was an estimated 18,000 kilograms. It can only be expected that the US will try to stockpile these metals and try to diversify imports, while there are some indications that the troubled Biden administration might move to increase domestic mining and refining of rare-earth elements.

However, this will require time and effort that will not prevent price spikes that are already affecting entire industries across the political West. According to Bernard Dahdah, an analyst at Natixis, the move by China is far from being the “nuclear option that it could have chosen”, but it’s the first “warning shot”, emphasizing that “China does control other metals through which it can inflict more severe consequences”. And this is certainly true. China’s dominance in rare-earth elements extraction and production is well known and while Beijing never intended to “weaponize” this, it is now being forced to do as the US and its vassals and satellite states are targeting China’s economic growth and technological innovations.

In the meantime, the Pentagon seems to be in quiet panic. On July 7, it announced that it’s invoking the Defense Production Act to boost the domestic mining and processing capacity of the two metals. This is because gallium is one of the key elements used in the production of advanced AESA (active electronically scanned array) radars used in modern fighter jets, air defense systems, ground and sea-based ISR (intelligence, surveillance, reconnaissance) equipment, etc. These radars heavily depend on the foundational materials of gallium arsenide (GaAs) and gallium nitride (GaN), with US MIC giants such as RTX (formerly Raytheon) and Northrop Grumman on the brink of launching new systems that primarily rely on GaN.

Such systems were supposed to provide superior performance over the older GaAs-based AESA radars and this advanced technology has already started being implemented into the radars for F/A-18E/F “Super Hornet” carrier-based fighters, as well as the deeply troubled F-35 stealth fighter jets. This will affect not only Washington DC, but also its vassals and satellite states that are taking part in US aggression in the Asia-Pacific, where they aim to “contain” China and curb its growth and development. The US (and now also the EU) routinely sends its fighter jets, strategic bombers and warships to the South and East China Seas, deliberately provoking the Asian giant.

china has 80% share of gallium and 60% share of germanium. 95% figure is absolutely not true.

i said up to 95%, depending on the source. and i’ve seen a lot of sources claiming anything from 80% to 95%. i never said i’m certain about that specific number, because estimates vary.

enjoy reading your pov/analysis; thanks.

thank you! i’m glad you do!

germany has the germanium part, not china. why do you think its called germanium stupid?

even with 60%, china controls the market, which was the point of the article.

this shows china is ready to attack america on its own soil, and make amerifats suffer.

russian wild hopes

since nixon the only country china ‘attack’ is russia. there is no benefit for china from war with usa. not after decades of cooperation at all levels. remember, russian soviets hated mao for his friendly business with americans.

russia is now banned from civilised world forever so chairman xi is already incorporating siberia with its native chinese inhabitants… it is happening and to late for russia to return…

its about time. hit those anglo pigs and their lapdogs. death to nato

just think about it. this ban was probably inspired by american secret services. those metals can be easily replaced by local production in usa in a very short term and now provides americans with excuse to start banning chinese products. as i said – the idea came to xi from either chinese officials bribed by us or xi is completely lost!