Originally appeared at ZeroHedge

Update (2130ET): North Korea has temporarily closed its borders to foreign tourists, two major operators of tours to the isolated country said, in an apparent effort to seal itself off from a new virus causing global health worries.

* * *

Update (2115ET): Chinese officials have just held a press conference that was anything but the usual CDC “everything’s ok” statement. The particularly ominous warning that the virus is mutating and spreading is perhaps due to the poor handling of the SARS breakout in 2002/3 which was marked by cover-ups and official reluctance to share information.

Li Bin, vice head of China’s National Health Commission, confirmed there are 440 confirmed coronavirus cases in this new outbreak and there have been 9 deaths. Some 1,394 patients are under medical observation.

Officials also confirmed Wuhan airport will have screening equipment (and Wuhan citizens have been asked to limit travel) and a nationwide monitoring system is being put in place (one wonders if the social credit score will go down if a citizen contracts the deadly disease).

Finally, the officials said that they will disclose information in a timely and public way and are doing their best to curb the spread of the disease.

And all of this is happening as hundreds of millions prepare to travel for the New Year’s celebrations.

Long facemasks; Short rats (2020 is year of the rat).

* * *

Update (1920ET): Just like we saw during past outbreaks of disease in China, a panicked population has bought up face-masks at such a frantic rate that several of their unscrupulous countrymen have resorted to gouging.

American brand 3M, a popular manufacturer of facemasks in China, has already sold out on its official online stores on e-commerce platforms Taobao and JD.com .

Meanwhile, guards at the Wuhan airport pointed electronic thermometers at travelers, with plans to segregate anybody showing a fever, an early symptom of the virus.

Several unscrupulous sellers who bought up masks en bulk are now managing to sell them for more than 10 times their original price. Some retailers were selling the masks for as much as 40 yuan ($7), a more than 10-fold mark-up. Users of Weibo, a Chinese social network similar to Twitter, warned anybody planning to travel to instead consider staying home, and repeatedly washing their hands.

According to certain sites that track prices of Chinese goods, the masks typically sell for 53 cents.

At one pharmacy in Shanghai, a shopkeeper named Liu Zhuzhen said more than 100 people had bought masks by noon on Tuesday. They sold out again after a re-stocking.

* * *

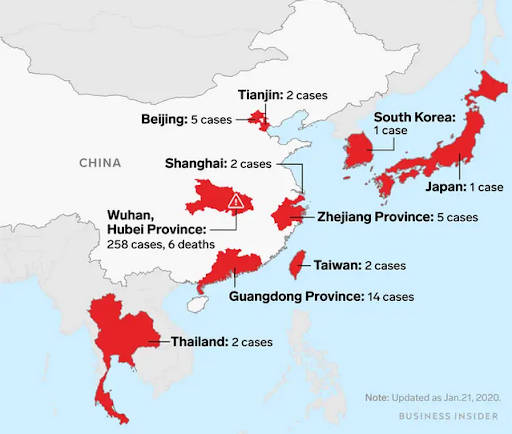

Update (1600ET): Beijing, Shanghai, Tianjin, Zhejiang, Henan, Chongqing, Hong Kong, Bangkok, Seoul, Tokyo, Brisbane, Taipei – and now Washington State.

The viral pneumonia-like lung illness first discovered late last year in Wuhan, a mid-sized Chinese city in the center of the country, has Beijing’s leadership – who are already grappling with slowing economic growth and continuing trade pressure from the US – very much on edge.

It’s clear now that Beijing’s initial response to reports of a new SARS-like virus was to dissemble. After initially insisting that there was no evidence that the virus could be spread by humans, health officials have now admitted that they were “wrong”, and that human-to-human transmission is possible, meaning that there’s no telling yet just how contagious this thing really is.

It’s already spread rapidly: In just a few weeks, it’s gone from a few isolated cases in Wuhan to nearly 300 confirmed cases, not just in Greater China, but also across the Asia-Pacific region, and now in the US. The fact that the CDC has already identified the first case in Washington State suggests that this is an aggressive pathogen, and health officials are duly concerned.

It has already confounded expectations. The fact that 139 cases – roughly half the total number reported – were only just identified over the weekend is especially unnerving, because now infected hosts have had time to scatter back to wherever they’re from, potentially spreading the virus across the planet.

According to Bloomberg, the US case has been revealed to be a man in his 30s who returned to the US last week, but not before visiting a public market in Wuhan…

The sudden spike in cases has prompted airports in the US, Australia and elsewhere to tighte illnesses has prompted tightened borders and a rapid attempt to trace contacts of those who have become ill.

On Wednesday, the World Health Organization will decide whether this crisis qualifies as a public health emergency of international concern, a label signifying only the most complex pathologies with the potential to cross borders. The WHO could recommend that travel be restricted, or that global governments take other drastic measures.

With global health officials on high alert, local authorities in Wuhan have announced that the city has 800 hospital beds ready in three separate designated care hospitals, and it’s ready to have 1,200 prepared at short notice, according to local media reports.

With the Chinese New Year travel season about to begin, many fear that millions of Chinese traveling abroad or internally for vacation will help the virus spread at an exponential rate. Chinese health officials have played down the possibility of this. But they also say they don’t want to underestimate it. After all, the last major outbreak, SARS in 2003, killed 800 people.

* * *

Update (1335ET): The CDC has confirmed that a traveler from China has been diagnosed in Seattle with the Wuhan Coronavirus.

The patient, who was hospitalized with pneumonia last week, recently had traveled to Wuhan, China, where the outbreak appears to have originated, federal officials have found.

Officials declined to identify the patient, who was said to be quite ill.

Additionally, on a conference call, the CDC confirmed it expects more US cases to come.

The outbreak began at a market in China and now has spread to at least four other countries, and has killed at least six people and sickened hundreds more in Asia.

Broadly speaking, stocks are getting hammered on this but there is one silver lining however, prices for flu-shot manufacturers are soaring: Nanovaricides +240%, Novavax +53%, Inovio Pharma +10%, and Vaxart +14%.

* * *

CNN’s AnneClaire Stapleton (@AnneClaireCNN) tweeted an ominous warning:

“The US Centers for Disease Control and Prevention is expected to announce this afternoon that the first case of Wuhan coronavirus has been reported in the United States, in Washington state, a federal source outside the CDC tells CNN.”

And the market reacted rapidly…

Transports are the worst hit on the day, already suffering from coronavirus fears overnight…

Can The Fed just print up some anti-virus?

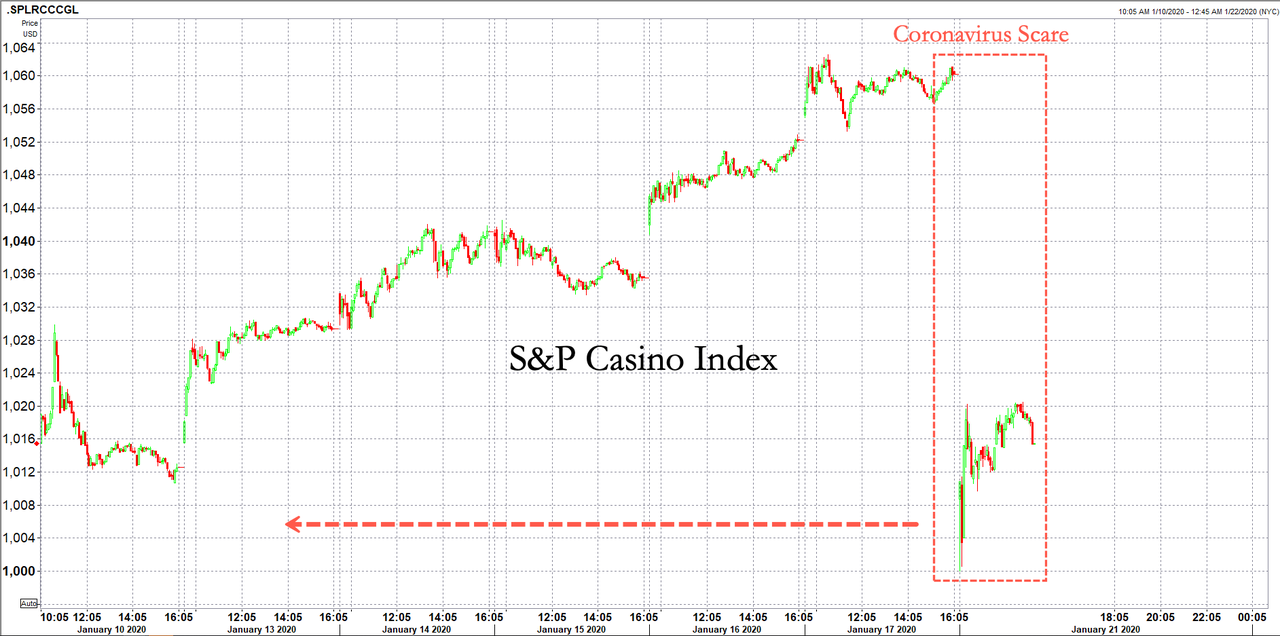

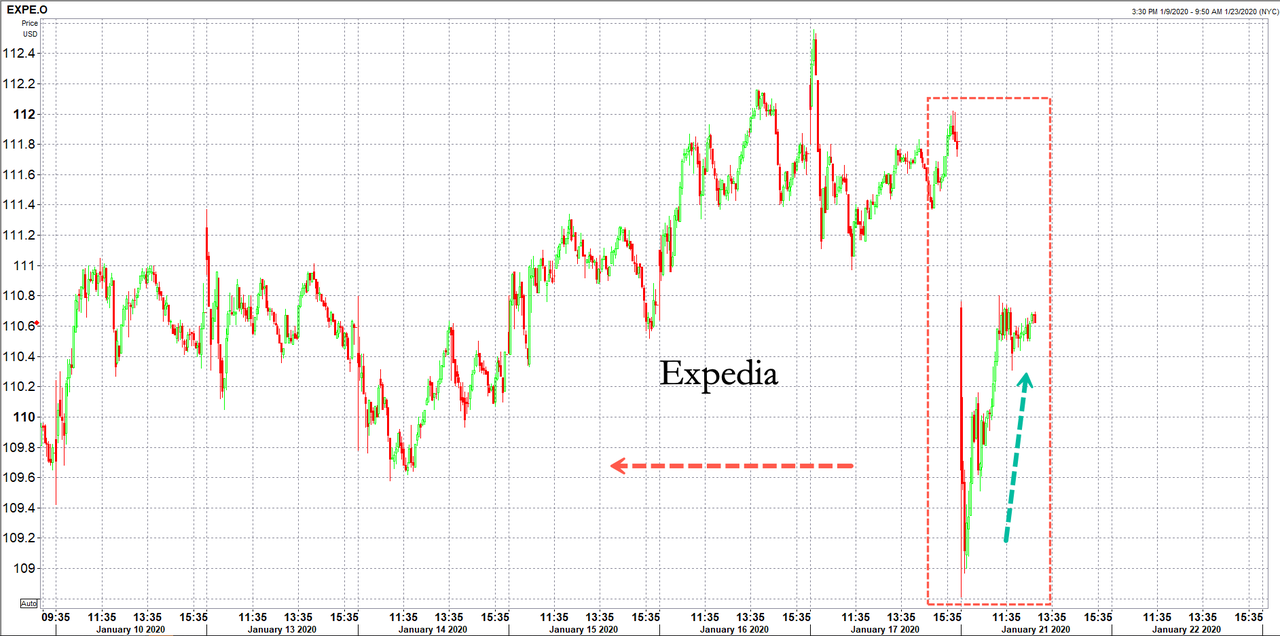

As we detailed earlier, the global risk-off wave had started in the overnight hours of Monday as the full extent of the Chinese coronavirus scare became apparent to traders, has rolled into the cash session Tuesday with airline, casino and gaming, hotel, and travel stocks, taking a leg lower.

Delta Air -3.50%, United Airlines Holdings -3.20%, Southwest Airlines -1.5%, and American Airlines Group -2.50%, were all sold as the outbreak may crimp global air travel during the upcoming Lunar New Year holiday period.

Investors dumped Wynn Resorts -4.45%, Las Vegas Sands Corp -4%, and MGM Resorts International -3%, as the virus threatens to decrease foot traffic.

Hotels were also sold, Wyndham Hotels and Resorts -1%, Choice Hotels International -1%, and Extended Stay America -1%.

Travel stocks were dumped, Expedia Group -1%, Booking Holdings -2.20%, TripAdvisor Inc -1%, and Trip.com -10%.

Investors are unloading sensitive travel stocks because confirmed cases of coronavirus have tripled since Monday and spread to other countries around China with the risk of spreading across the world.

Fears of a 2002-03 outbreak of SARs has been on everyone’s mind to start the week – and with a Lunar New Year holiday fast approaching – the spread of the virus could broaden in the days ahead.

Travel sensitive stocks have taken a beating in Asia, Europe, and the US – basically across the world on Tuesday, as investors brace for new cases of the virus that is quickly spreading.

Could this mean world stocks are due for a pullback?

Have ‘Daesh’ claimed responsibility for it yet?

I’m sure theyd like to lmao

I’m sure they will eventually as they constantly crave attention!! I’m surprised they haven’t yet claimed the bushfires in Australia!!

Maybe if australia pissed off isis’ paymasters somehow they would lol

God please let this thing be contained and stopped please thank you