On May 5th, Brent crude oil price went up by 13% up to $30 per barrel, but this isn’t a sign that the economic downturn is being reversed for the better.

The price of Brent is a week-long increase, returning from below $20 per barrel.

Stock markets also made gains, despite a decision by the German constitutional court that appeared to undermine efforts by the European Central Bank (ECB) to orchestrate a eurozone-wide stimulus plan.

Analysts said while the better news from China had improved the outlook for oil consumption, there was still a glut of oil on world markets and prices were likely to stay low for the rest of the year.

Goldman Sachs raised its Brent forecast for 2021 to $55.63 per barrel, from $52.50 per barrel earlier. The bank also increased the value of US WTI oil from $48.50 per barrel to $51.38.

Oil production within the OPEC alliance began to decline rapidly due to the reduction in the scale of operations, the closure of enterprises and the operation of the agreement to reduce production. Demand is also starting to recover from low indicators, which is associated with the recovery of the Chinese economy and the growth of transport demand in countries with developed market economies, the bank said.

Global stocks are now 24% above their March lows, mostly after investors piled into internet and IT stocks, including Facebook, Amazon and Microsoft.

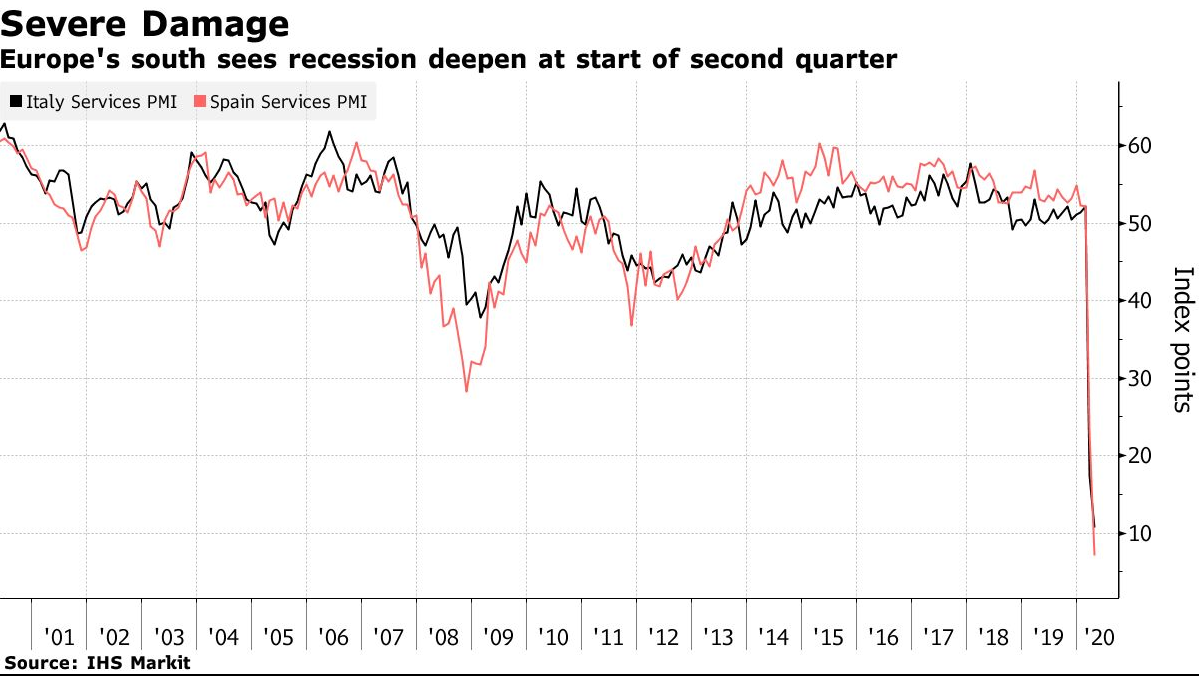

In Europe, Italy and Spain are suffering in an economic slump, with jobs being cut at the fastest pace in 22 years.

Prospects for the next 12 months are equally dire, fueled by concerns that the many weeks of restrictions have inflicted long-term damage on the economy.

The figures come after data showed January-March economic output fell about 5% in Italy and Spain, and only slightly less in the 19-nation euro zone.

The European Central Bank has warned GDP in the bloc could decline as much as 15% in the second quarter, telling governments “joint and coordinated policy action” is needed to underpin an eventual recovery.

“Observing the sheer scale of the drop in many survey indicators lays bare the impact that the pandemic is having on Spain’s economy,” said Paul Smith, IHS Markit’s economics director. “We estimate the economy is currently contracting at a quarterly rate of around 7%.”

“With the gradual easing of restrictions planned to begin in early May, next month’s data will give the first indication on how fast we can expect activity to recover in the short term,” said Lewis Cooper, an economist at the London-based firm.

Even in the best scenario, rebuilding the economy will take time. The International Monetary Fund predicts a euro-area slump of 7.5% this year, followed by growth of 4.7% and 1.4% in the subsequent two years.

The US could potentially fall into an even deeper slump, with the US Treasury planning to borrow $3 trillion to battle the fallout with the COVID-19 pandemic, the lower price of crude oil and the lack of storage space.

MORE ON THE TOPIC: