Written by Prof Michel Chossudovsky; Originally appeared at Global Research

Haikou, Hainan: In an unusual twist, financial experts have called upon China’s monetary authorities to let the Renminbi float to “ease risks” (China Daily, October 31, 2018). Sounds contradictory? At this juncture, the Forex market has become weaponized. The policy of “Floating the Yuan” has contributed to the RMB’s dramatic decline.

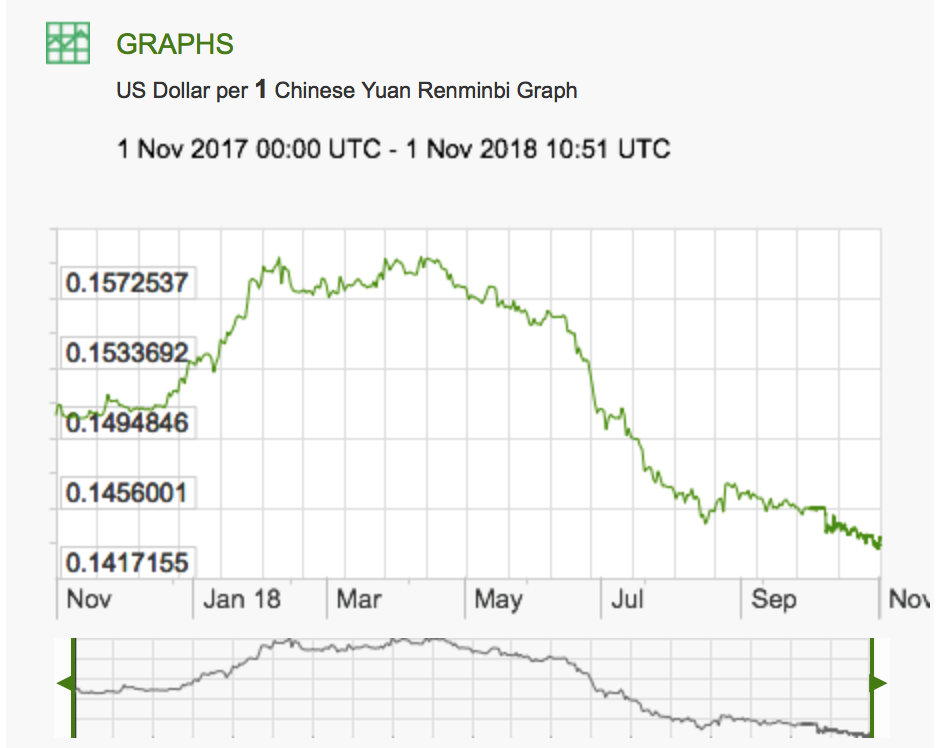

Various market related concepts (including hikes in US interest rates and China’s trade surplus with the US) are put forth (out of context) by “authoritative” Western economists in support of an “RMB Float”, which in the last few months has led to a slide of the Yuan to its lowest level since the 2008 economic crisis (see graph below).

“By analyzing the recent signals from the authorities, as well as market performance, they [the experts] believe that the government much preferred a freer Renminbi, or allowing the market to decide.” (Ibid)

“Allowing the market to decide” is a nonsensical concept. It certainly does not apply to currency markets, which are the object of manipulation and speculative trade.

In making this economic assessment, the geopolitics, the trade wars, are casually ignored. The “experts” quoted in the China Daily report are for the most part tied to Western and Japanese institutions. Their assessment conforms to that of the IMF.

Visibly, the recorded RMB decline of 11.1% against the US dollar since April 2018 coincides with US-led the trade war. (see graph below). It has occurred despite the fact that both Russia and China have been dumping US Treasuries.

Who is advising Beijing with regard to the RMB and forex market?

According to Zhou Xiaochuan, governor of the People’s Bank of China (PBC) a so-called managed floating RMB exchange based on market supply and demand criteria has been applied. This structure essentially follows the guidelines set by the IMF.

At the height of a US trade war against China, not to mention what Beijing considers an act of provocation by the US Navy in the Taiwan Straits, the Renminbi is indelibly under attack. For the People’s Bank of China to faithfully follow IMF guidelines is tantamount to abiding by the Washington Consensus.

Remember the 1997 Asian Crisis? The currencies of South Korea, Thailand and Indonesia were subjected to large scale speculative operations including naked short-selling by major banks and financial institutions leading ultimately to a dramatic collapse of the ROK Won, the Thai Baht and the Rupiah.

These countries were forcefully pressured by the US Treasury and the IMF to lift all protective measures and let their currency float.

It is worth noting that in contrast to the fate of these three countries, Malaysia under the helm of Prime Minister Mahathir Mohamad successfully put together a carefully designed counter-speculative program to protect the Malaysian Ringgit.

Today’s speculative instruments are far more sophisticated than those prevailing during the 1997 Asian Crisis. We are dealing with financial warfare and the central role of the forex market in disrupting national economies.

In recent developments, the Russian Ruble and the Turkish Lira, have been pushed down to exceedingly low levels.

Amid trade tensions and veiled US military threats against China, IMF guidelines on currency management should be disregarded. The “Renminbi Float” should be analyzed and reassessed in relation to potential US sponsored speculative operations in the Forex market. It is essential that The People’s Bank of China (PBC) put together under the guidance of China’s leadership a carefully designed counter-speculative framework not only to protect but also to reinforce the Yuan in relation to the US dollar.

Letting the US control the value of your currency is suicide.

The whole idea of floating currencies is an American plot to control the world.

Fight back, short the US dollar, buy gold or silver, and kill these bastards once and for all.

Yea, the dollar is shorted when Treasury bills are sold. There is a big short coming from the Chinese, if Trump insists on being a bellicose negotiator.

When gold reserves reach adequate levels, and debt service becomes problematic, then you start selling naked shorts of trillions of dollars.

When you sell your US treasury bills, what do you do with the dollar bills you receive?

Chinese owned US treasury bills are China’s economic S400.

If the US tries to crash the Yuan, China starts selling US treasuries to protect the Yuan, which pushes the dollar down. Using all their ammo at once and too early is not a smart move.

“””When you sell your US treasury bills, what do you do with the dollar bills you receive?”””

Sell them and convert them into whatever currency you want or gold.

Buy gold and take delivery of it, instead of paper certificates.

Have you seen any dollar “down” after Russia sold their last and China also sold a big punch of dollar? I have not seen any “down”.

Russia sold its treasury bonds over 2 months, to maximize profits, but even that pushed up US treasury interest rates.

When China sold some of its US treasuries in 2015, to support the Yuan, yes the dollar declined, the US backed off, China stopped selling, and the dollar came back.

Those 3 economies are not to compare like that at all. Our productions are based on stockings and shareholder added trust or the opposite.

I think you mean stocks, stockings are the things some women wear on their legs.:)

Check out the gold price, relative to the US dollar.

When the dollar goes down, gold goes up, and vice versa.

The US pretends that gold is an anachronism, but spends a lot of freshly printed money controlling the gold price. That’s why the US created paper gold, the real stuff kept going up and up, until the US came up with paper gold in 1974, and it took until 1980 to convince the market that the US would pay any price to keep the value of gold from destroying the dollar

https://goldprice.org/charts/history/gold_all_data_o_x_usd.png

Gold is just a mineral. Its no representative for money in the world as it once was.

Gold is default safe storage for capital in times of markets crisis – it does not dramatically lose value in same way as other market investments during these times.

So why does the US dollar go down, when gold goes up?

Its opposite. The dollar loses value because investors trust it less, then gold raises because its the ultimo secure investment.

Gold is not just. Gold is the finest mineral and eternal. No other mineral has this qaulity.

Good one. But……………….the connections is not easy. I better like the explantion if you could buy 100 chickens for 1 oz in 1900, you can also buy 100 chickens for 1 oz today 2018 :-D. But I know this is not true either.

https://uploads.disquscdn.com/images/f9fc731b3e534d6d47b5748dfb344e6768d56195aa1b454bd53d24976a1d1e51.gif

Floating they yuan and allowing it to devalue in a controlled manner makes US sanctions ineffective, since Chinese goods cost less in dollars and the 25% tariff is blunted making Chinese goods still bargains with tariffs included. If the yuan stays at this level, the net price increase for Chinese goods because of the tariffs would be 12-14%.

I see kind of that too. Others in the world also can make regulations and follow it. Fx the EU talk about products from China has become almost too cheep, and their answer will be to tax them up to equal.

More then a pocket calculator is needed for that, because many things in EU are produced or partly produced in China.

“Allowing the market to decide” is code word for “Allowing the Jew to decide”.

We are all jews besides You morons being some dirty little minority hardly washing their mouths every friday.

Best regards to the 1001 arabic nights of everlasting excuses for no change. If Russia and China took over, You will still be low.

shut up kike

I’m not a Jew, a thank God Almighty I’m not, because what a curse that would be.

Imagine having to lie, cheat, steal, murder, genocide, militarily occupy other peoples land, learn the diabolical Rabbinical Talmud, sorcery and black magic of the Kabbalah, ritual murder/sacrifice’s, lack of compassion, empathy, endemic psychosis, phallus worshipping filth that are half Neanderthal, half Homosapien. No, not for me. I feel no sorrow for you.

And muslims do none of that ?

Yup, you nailed it. It all comes down to the Jews losing control of the global monetary scheme that they have nursed and reared for centuries.

But the Chinese are a wise and ancient people, they know full well that the global troublemakers are Jews.

People who tell to buy gold need to remember to buy physical gold not Paper Gold. Paper gold is a fraud and is controlled by the same banking cartel families that control the fiat paper currencies of the world ie the Rothschilds. They have their dirty sticky fingers in all things financial and then some. They are the real masterminds behind this current episode of economic upheaval. It is all a plan devised years ago to bring about control of the worlds currencies through a worldwide currency collapse then a restructuring process that will implement a one world currency, possible digital currency (makes sense doesn’t it really). It is all “meant to happen”. Can you or I stop it? I doubt it very much. But if your aware of the scam then at least that is something. We just need that critical mass of awakened people maybe to at least change the plan somewhat or even to stop it…maybe…hmmm I’m not very optimistic thou.

We also controle the price of gold bullion as we own the majority of this too……………….LOL. Pump and dump………………….LOL. You guys cant do a shit.

Thinking economy like that is from ancient times.

You are right about dirty economic warfare, but its not about gold.

Oil is much better. If the oilpirces goes down, Russia is almost bankrupt, so they prefare high oilprices. That why they are are so narrowminded in their export sector.

Countries should spread out having many products. Here You for good reason can say, they all are diferent kinds of gold – if one or two goes down, the rest stay or goes up.

Agree 100%. Very good article from Michel.

Floating is made to find the correct price for the currency. It has ben well known for many years, that China had to meny cheap dollatd in their banks. So floating for China also say, that they outbalance and find a stabile lower level.

The low Yuan also say, its easier to export, but it also make it more fifficult for others to be in the Chinese production inside China. USA and WE(EU) dont like the last part. The internal risk in China would to my oppinion be inflation unless they sell a lot more outside and do not use the larger production for Chinese consumers only.

A typical western reaction is to freeze and delay money. I do not know how China is. We tell all, they has to put some% of their money into a pension fond, and they by that get extra, when they retire. In the meantime the pensionfond grows, the money in it is invested in stockings, so the money help investments and the pension fond investors.

Another version is to raise taxes and use it fx for building roads, airports, bridges, hospital, schools and to educate more people better. So when the crises might come back, You have an updated infrastructure and a better educated and more flexible population.

I would add that Trump and my Goverment has learned bothing from 2008. The Yuan acting by China make a lot of sense. They do have a risk, and thats we need to tax the much cheeper products in favour of our own protection. So it – to me – would be much better – that USA did some good internal reforms creating middle class and upperclass jobs by educating more people much better.