On April 20th, Art Berman published an analysis, looking intricately at data regarding the oil market, in 2020, and prior. [pdf]

Notably, his analysis made some valid points, such as that “energy is the economy and oil dominates energy. The economy does not run on money; it runs on energy.”

The current situation in the oil slump, the oversupply and the massive dip in demand are a result of the fact that “most people are “energy blind” and can’t see what’s happening.”

According to him, in a very bleak prescription – 2020 oil demand will fall by 16 million barrels per day, and global GDP would go down between 15-20%.

“Energy choices will default to the cheapest, most efficient sources: oil, natural gas and coal. The push toward renewables will languish.”

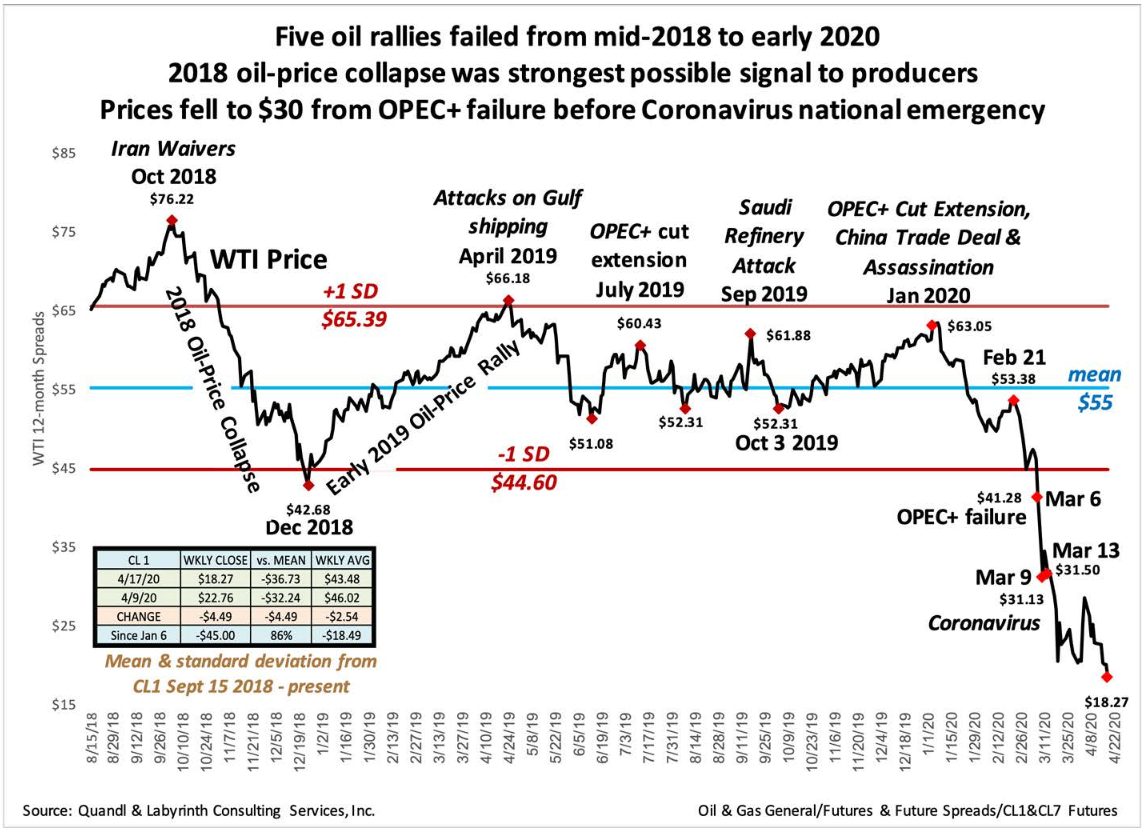

With ample data and graphs, he presents the “open secret” that the oil market was going towards a crash even before the COVID-19 pandemic. Similarly, as the virus does, it just made the situation worse and may lead to death.

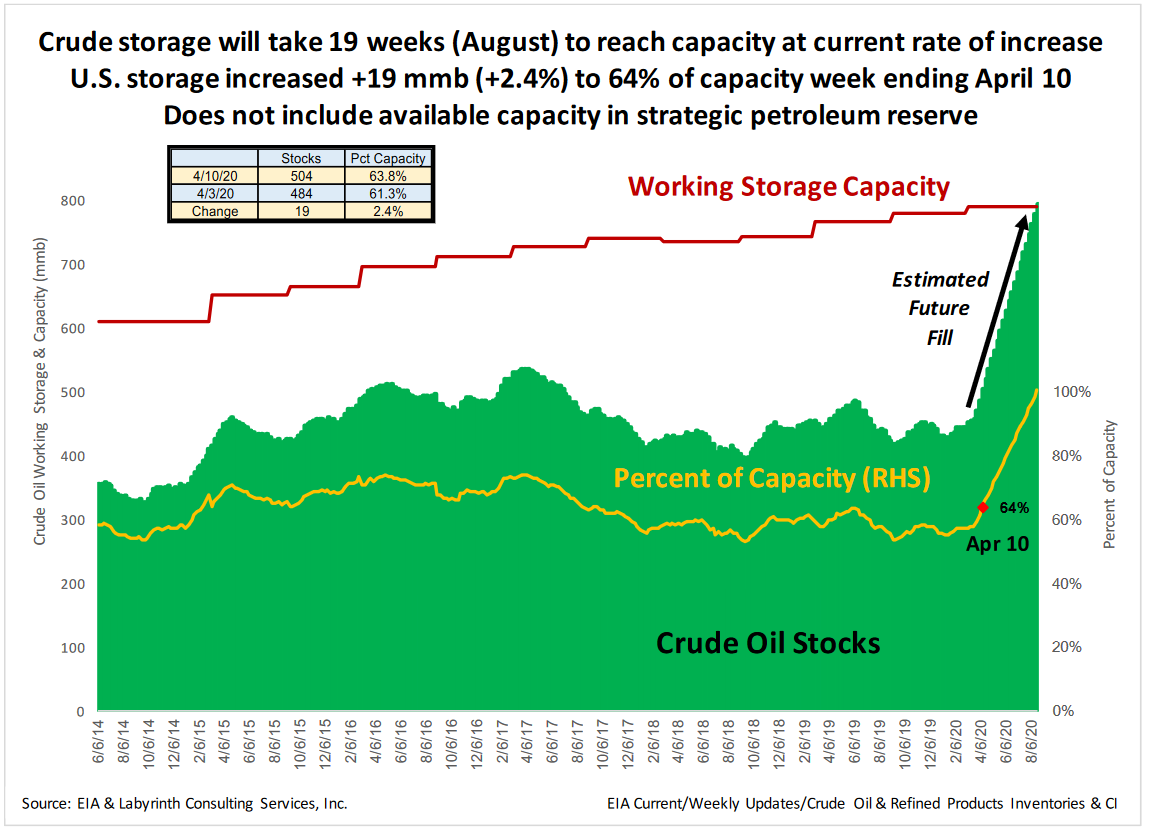

Furthermore, the storage facilities will all be full in 19 weeks if the tendency continues, thus somewhere in August, there will be no more free storage space to keep the crude oil that is being pumped out.

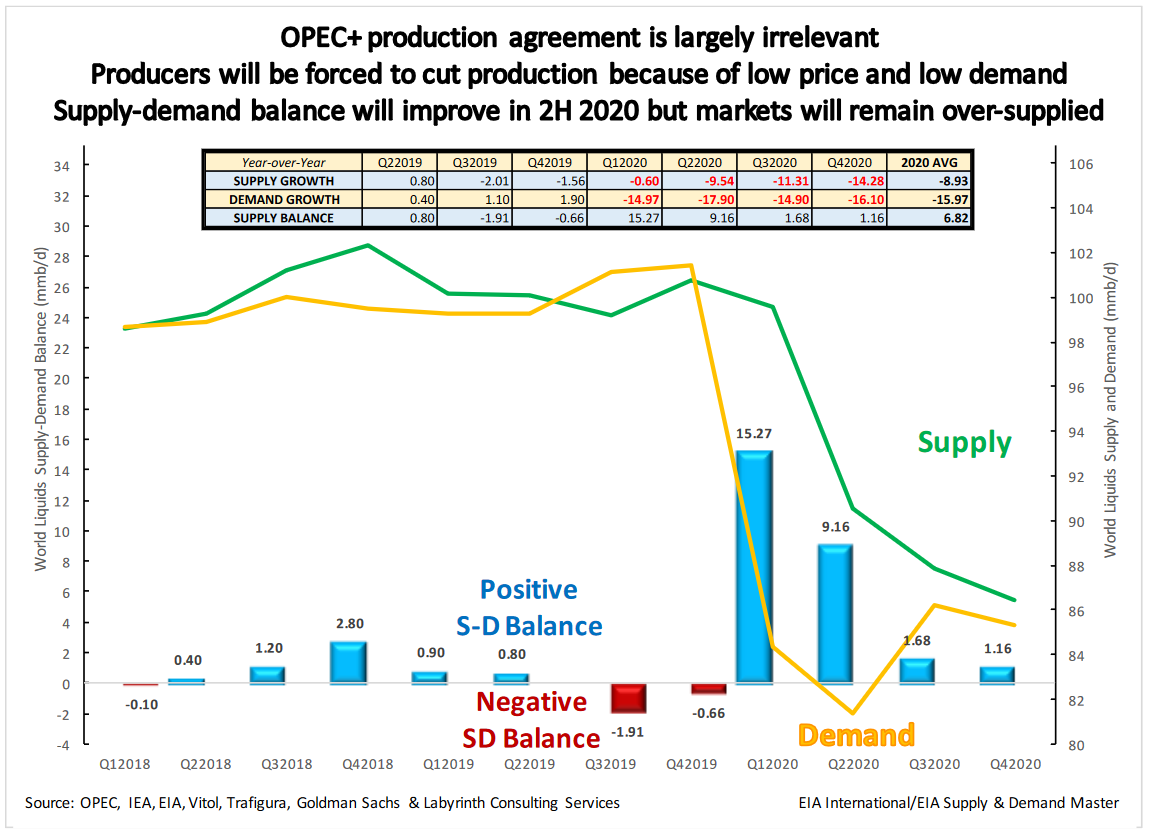

As has been repeatedly said the OPEC+ agreement to reduce production is mostly irrelevant, and that the producers will be forced to cut production even more due to low price and low demand, even though it costs a lot to re-start production once it’s been wound down.

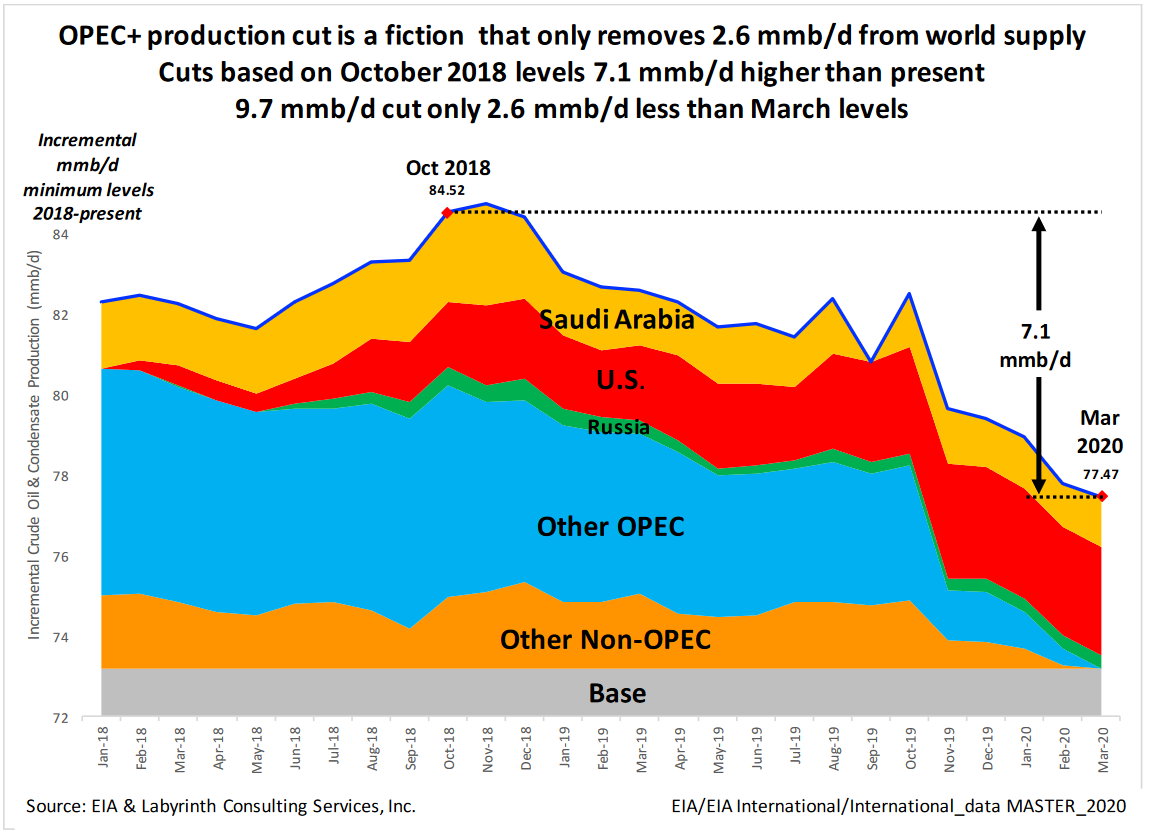

Additionally, the cut in OPEC+ production is a fictitious number that doesn’t really present what exactly has been reduced, and increased and that it misrepresents the situation.

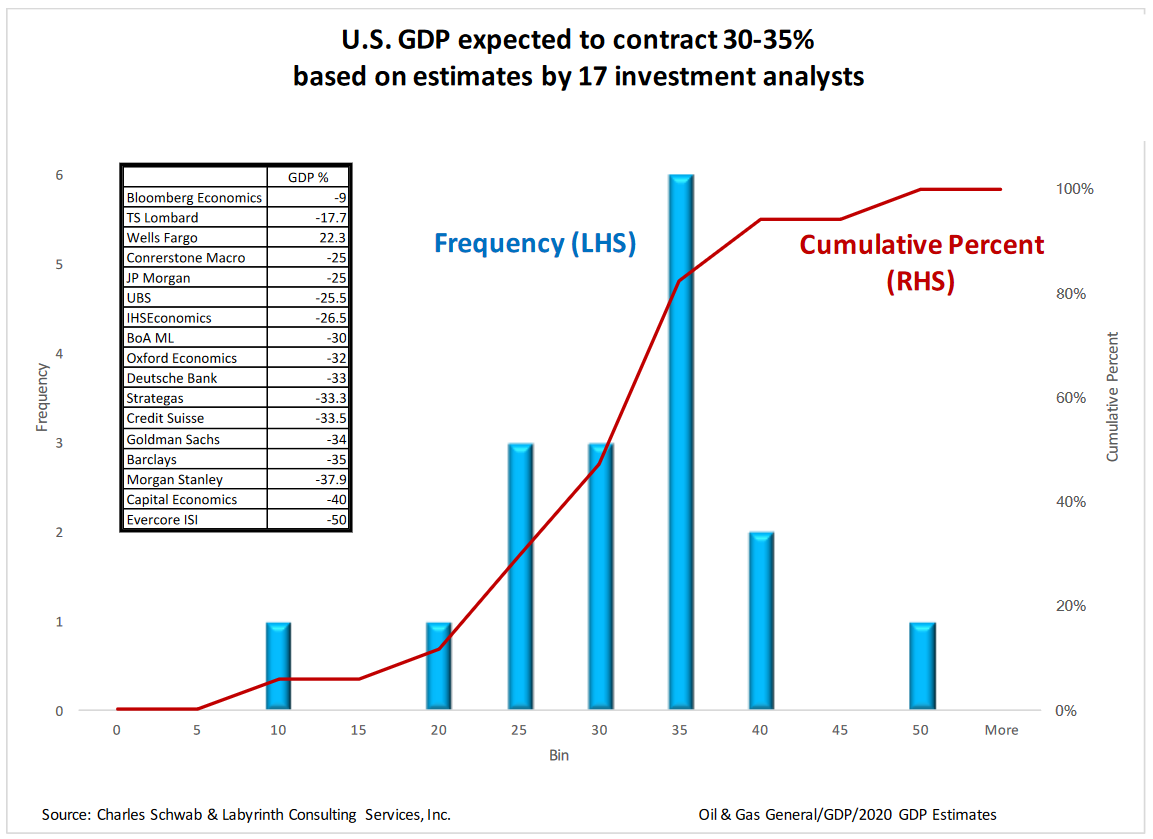

As per estimates by 17 investment analysts, the US GDP is expected to shrink between 30-35%.

And that is a direct result of GDP being proportional to oil consumption.

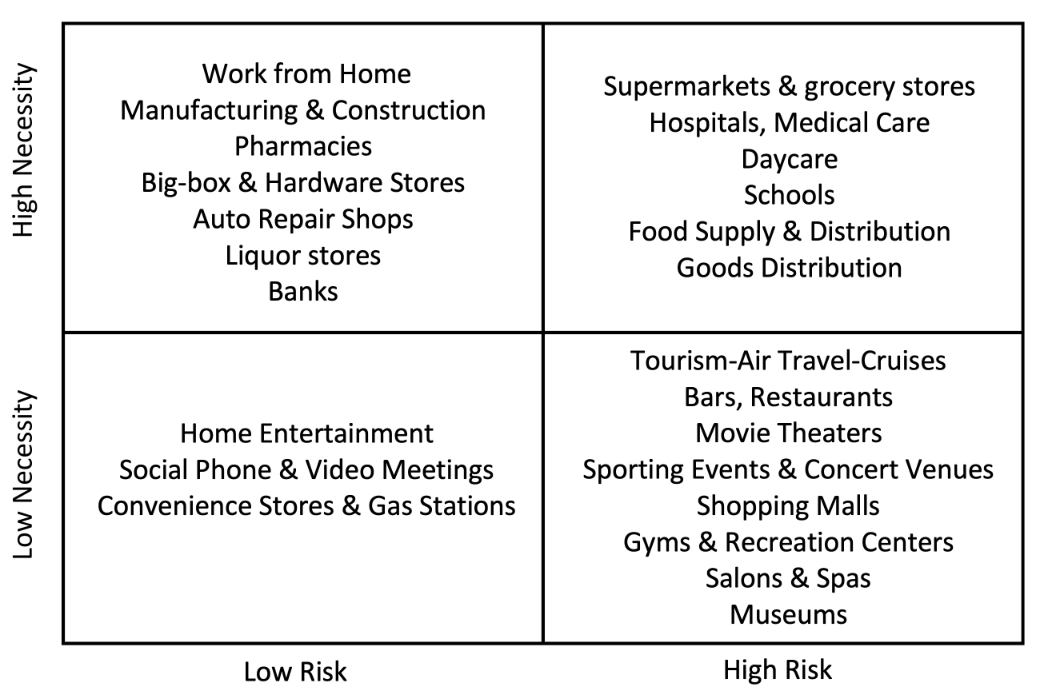

That is also added to the fact that as measures against COVID-19 are eased, the higher-necessity and lower-risk measures will be lifted first, with others lagging behind. Most of those that require oil are in the higher-risk, lower-necessity section.

In conclusion, Art Berman made the following statements:

- The old economy is gone. Re-opening is only a partial solution with unknown, unintended outcomes;

- Oil markets will adjust & prices will increase slowly once there is a path out of economic closure & a partial restoration of employment;

- Managing the oil markets has resulted in failure and needs to be avoided in the future. Essentially, it could be that Adam Smith was right all those years ago.

- There would be less focus on renewable energy and climate change.

- The greatest near-term risk is a total crash of the financial system due to cascading defaults and a collapse of the developing world.

And as such, following the crude oils going on the negative, this creates a precedent that the entire financial world moves toward that.

The negative price of WTI, which has since recovered, made all market models crash and traders can’t use them to calculate risk.

The standard pricing models used for options on futures and swaps cannot cope with negative indicators. If banks cannot correctly calculate risk indicators, this will be a huge problem for them, according to Richard Fullarton, founder of Matilda Capital Management, an oil trading company for over 20 years.

Without a strong international security formula, the global market cannot function. Political risks cannot be hedged by market methods. There is no doubt that the United States will pump oil shale to the last with helicopter money, in the hope of spreading its costs throughout the global oil industry and forcing other countries to reduce production in parallel with the “natural” shrinkage.

MORE ON THE TOPIC: