Originally appeared at ZeroHedge

When the Senate unanimously passed a $2 trillion economic rescue plan late last night, it was targeting tens of millions of middle-class American households many of whom had lost their jobs, and whose lives had ground to a halt due to the global coronavirus pandemic and lockdown. It certainly wasn’t targeting Wall Street bankers.

Naturally, the Congressional stimulus plan which is set for House passage tomorrow, received much publicity – after all, some of those trillions in stimulus payments will end up going into the pockets of America’s workers, and while the final amount is a modest $1,200 per month, both Democrats and Republicans – and the President of course – will take full credit for the handout (while blaming each other for the far bigger corporate bailouts that are at the core of the package).

What has received far less coverage is that to fund this plan, the Treasury will have to issue trillions and trillions in new debt, much of which will be quickly monetized by the Fed (whose balance sheet is now $5.5 trillion and exploding), in what is essentially the arrival of helicopter money in the United States. As a result of the ongoing panic among capital markets participants who are scrambling to respond to this tsunami of new debt, there has been a surge in demand for cash and cash-equivalent products, including gold – which as we discussed earlier this week can not be found at virtually any merchant at a price remotely close to spot – and short-term Treasury Bills, those maturing in 3 months or less.

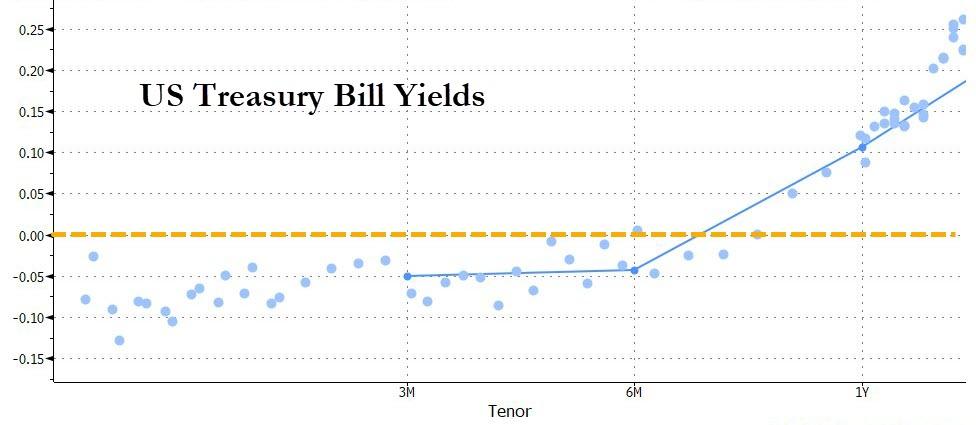

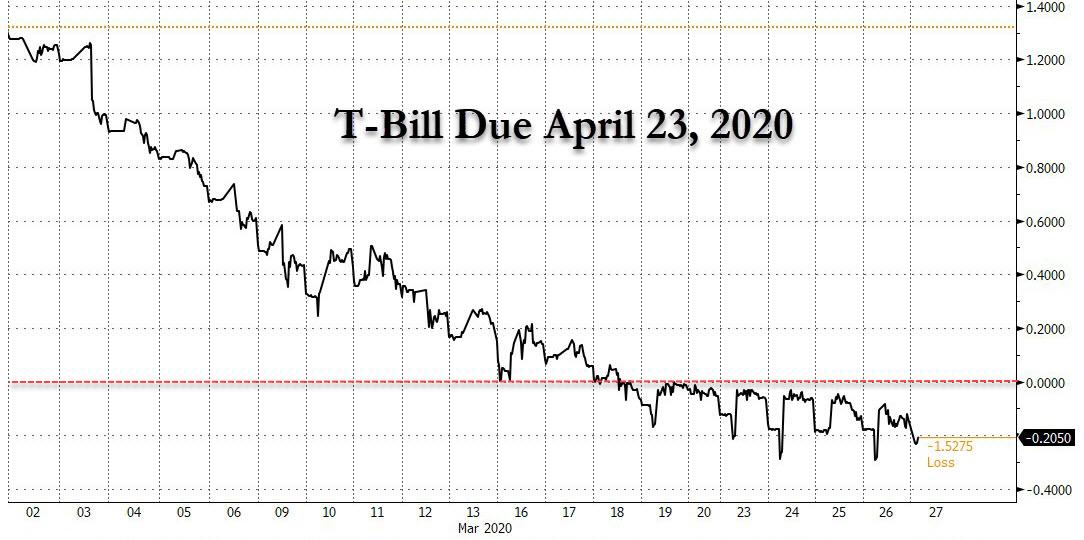

In fact, so intense is the scramble for near-term Bills that they are all now trading with a negative yield all the way to the 3 month mark, and in some cases, further out.

It is this unexpected drop in hundreds of billions in US Treasury Bills into the monetary twilight zone of negative interest rates that represents a far more secretive if far more generous handout amounting to millions in virtually guaranteed handouts to Wall Street’s bond traders.

But wait, the US doesn’t have negative yields, at least not yet, so why are Bills trading below zero. There are several answers, but the key one is traders’ preference to park cash not in their bank – which suddenly may have the dreaded “counterparty risk” thanks to some $40 billion in borrowings on the Fed’s Discount Window…

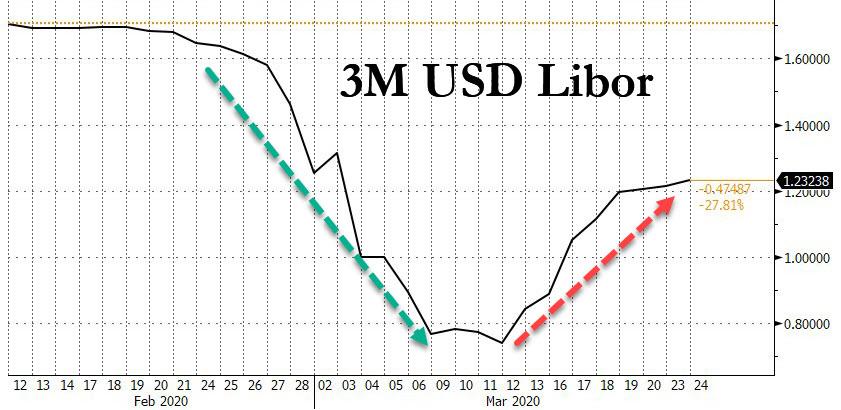

… and a bizarre surge in Libor that is hinting at one or more banks suffering from a liquidity crunch…

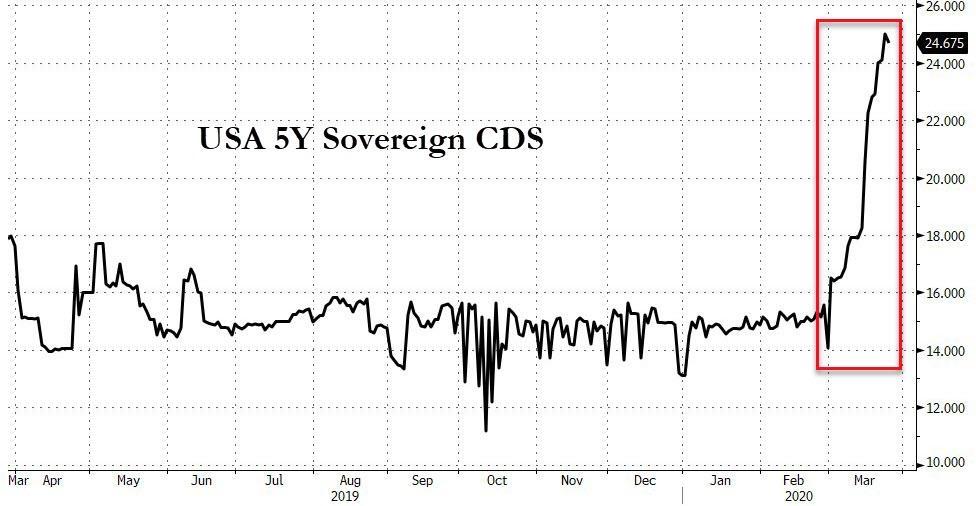

… but in the safety of debt instruments backstopped by Uncle Sam. After all, if the US were to default, which judging by the recent surge in US CDS is something quite a few are considering….

… investors would have far bigger problems than withdrawing their money.

And it is here that a fantastically profitable arbitrage has emerged, one which is far more generous to Wall Street bond traders than the fiscal bailout is to the middle class, as it is literally handing out billions in risk-free money to pretty much anyone who figures it out.

You see, unlike Germany, Switzerland or Japan, the US Treasury is prohibited from issuing debt with negative yields. Why? There is no one specific reason, but as Bloomberg, which first noticed this arb, points out “one reason the government might not want to allow negative-rate bidding is that it risks signaling to investors that negative rates are here to stay. Of course, since it is only a matter of time now before the Fed follows the ECB, BOJ and SNB by sinking into NIRP, this arb may soon disappear, but for now read on.

Effectively what the arb boils down to is taking advantage of the maximum price, or rather minimum yield limit of Bills sold to the public (but mostly to Wall Street traders) and the unlimited yields these Bills can trade in the open market.

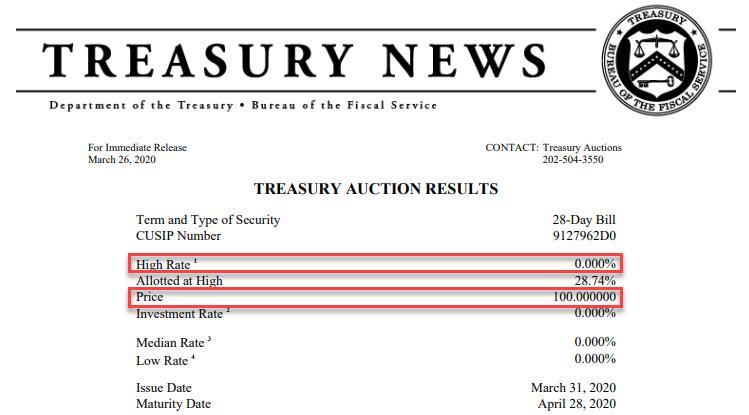

Take the following example picked by Boomberg: on Thursday, the Treasury sold $60 billion of four-week bills at the minimum allowed rate of 0% (at a price of par, or 100 cent on the dollar).

But because the current yield on this security is roughly -0.14%, dealers can turn around and sell those bills at a premium to par, and pocket an immediate windfall of about $7 million. While that might not sound like much, with over $2.5 trillion of bills outstanding, and rolling every single month, it could add up very quickly, amounting to over $100 million every month in risk-free handouts directly from Uncle Sam if the yield on the short-end remains negative!

Another example: in addition to the four-week bill auction above, Treasury sold $50 billion of eight-week bills on Thursday at an auction rate of 0%. But in the open market, eight-week bills now trade at -0.1%, yielding a price that is above par, or over 100 cents on the dollar. (A quick BBG refresher: T-bills don’t actually pay a coupon, but are instead sold at a discount to par, which reflects the effective interest rate on the security. At 0%, the price would be 100 cents on the dollar. If the Treasury allowed negative-rate bidding, the securities would be sold at a premium.)

As Bloomberg notes, the presence of this risk-free trade “has the potential to cost U.S. taxpayers billions of dollars if rates stay lower for longer, particularly as the U.S. is poised to issue more debt after the Senate passed a $2 trillion rescue package this week.”

“The Treasury absolutely, categorically, right now has to be thinking about this,” UBS economist and a former Treasury official and adviser to the Fed, Seth Carpenter, told Bloomberg, as this trade is “essentially just transferring wealth to other people. The Treasury is in a bind and they have to make a decision on this with bill rates being negative as they are.”

Curiously, it turns out that the systems to eliminate this unprecedented arb are already in place. In 2015, when bills also traded at persistently negative levels amid supply cuts to keep the U.S. under its statutory debt limit, Treasury adjusted its systems to allow it to handle a negative auction rate, according to former Treasury officials familiar with the matter. However, according to Bloomberg, it never followed through and changed its policy.

One can only imagine why “nothing changed” in this dark corner of the Treasury market that allows bond traders to literally print free, guaranteed and perfectly legal money with the full blessing of the US Treasury. It is also hardly a surprise why virtually nobody would talk about this trade: after all if you have a golden goose, why bring attention to it?

And yet now that everyone knows about this trade, there may be little the Treasury can do to stop savvy traders from collecting millions every single day, absent permitting negative-rate bidding to eliminate the primary-secondary market arb.

As noted above, the Fed may not want to give the impression negative rates are here to stay and that negative Bill yields are just an abberation (that “explanation” may have worked before, but now that helicopter money is here, it no longer will). Then there are political considerations: while the Fed has made clear it doesn’t see negative rates as a viable policy tool, President Trump, has been pushed Powell to follow the ECB and cut its benchmark rate to below zero.

“It’s a political hot potato,” said Ward McCarthy, chief financial economist at Jefferies and a former senior economist at the Richmond Fed. And “philosophically, I am just opposed to investors paying the U.S. government to hold their debt. Especially since small investors tend to be especially involved in the Treasury bill market.”

We agree Ward, but unless you can tell us where we can buy physical gold in size and at spot, Bills it is especially once a depository institution fails and the bank runs begin: at that moment, negative yields will go well into coupon territory.

Incidentally, Bloomberg points out that this is not the first time the issue of negative-rate auctions has come up. In August 2012, in a statement presented at its quarterly debt-refunding operation, the Treasury’s then-assistant secretary for financial markets said the government was “in the process of building the operational capabilities to allow for negative-rate bidding in Treasury bill auctions, should we make the determination to allow such bidding in the future.”

Mysteriously, those capabilities never came online. Maybe because the “then assistant secretary” planned to work at a bank that is now making tens of millions from precisely this trade?

Yet even with bill demand as high as it’s been, competing priorities could keep the Treasury from pulling the trigger, at least for now.

“Selling bills at negative yields would benefit the taxpayers, but would put the Treasury at odds with the Fed, which hasn’t sanctioned negative rates,” said Mary Miller, the Treasury’s former undersecretary for domestic finance in the Obama administration, who is now running for mayor of Baltimore. The current situation “may just be a temporary disruption, so it’s worth watching to see if this rights itself with the big economic rescue steps.”

“Temporary” maybe. But what happens when, not if, the crisis returns and investors have no choice but to park trillions into the “safety” of the Bill market sending yields far below zero and on a rather “permanent” basis. Which brings up another question: just how much undisclosed taxpayer subsidies do the banks get courtesy of Uncle Sam every single day, and what happens when the current crisis fully spills over into the banking sector?

So we have the scenario where gold and silver are now hard to find, and the crisis is just getting started. Anyone holding any fiat currency, especially the U.S dollar are going to be wiped out.

The U.S is about to become Zimbabwe 2.0.

To the deniers good luck to you, your going down with U.S ship.

that IS the satanic Zionist plan

No, You are

Obvious You dont understand a thing about Our kind of Economy.

You probatly is a Russian still admiring Engels. Russians always talk about gold because they have nothing else of value apart from gas for free into a market, which hardly is there for a period and will give a low income i dollar.

We are not like the Kursk Sub. , Your smoking and tilting aircraft carrier or Your rusty nukes east of Archangelsk.

We an and will decline for a period and also has to restructure parts and make new ones. And why? We have a high level and therefore we ccan decline and dont sink.

what is obvious is that u r entirely ignorant of macroeconomic theories—denmark is an amerikan colony—my Dane friends in Copenhagen, Roskilde, Lynby, Arhaus r ashamed of Rasmussen, Stoltenberg, etc

It seemes You are expert in very small micro economy.

Russians are lazybums and only makes 11.000 dollar pr capita when we makes 59.000 dollar. To be like You we should work less then 2 hours a day.

Danes invented windturbines for commercial use and it now covers 42% of all electricy we use. Soon we will need no oil and gas forom anyone.

We are in Western Economics and therefore mainly makes the most advanced things.

And Our relations to USA is quite clear. We are close to them and i pays off. They are number 2 in our export and buys for 20 billion dollars from us in advanced products only. They sell us for 9 bilion dollar, which mainly are food for pigs.

According cars we produce a lot of electronics for german cars. We also re do cars being specilised where normal cars dont fit in. That includes firebrigades for airports.

Your version of what we produce, sell and buy is completly outdated.

We also are big transporters and have Maersk Line, DSV Panalpinas as well as many others.

Danes did “Hirman” and we have sold patents as well as production of smaller drones to the American armed forces. And Yes they have ordered 250 units for missiles on the old F16s as well.

If You men were a little less macho and lived more halthey here, they would be 9 years older burning when its needed and on stanbye when it mainly is not.

I forgot Vestager being an Administrative Leader for taxing big companies in EU better. We dont need Your kind of Macho Pin Qeens. Our women are opmized and added with more soft men, thats a good combination.

On the flipside, all over the West are now printing money like crazy so governments can foot the bill with massive stimulus packages while state taxes are plummeting. More money into a shrinking economy = lots of inflation. Corona itself is a short term out of context problem, nothing like the burst bubble of 1929, which was structural in nature. But printing trillions of dollars and euros and kronas (I think?) is bound to have a long lasting negative effect on the economy. This may be a case where the long term effects of the cure will be worse then the short term disease. And Western currencies are backed by not a god damn thing. It’s all about faith in the economy. Print too much money and the money backed by not a god damn thing will become worthless. Whereas having lots of natural resources, especially gold, will be better to have in an inflation fueled economic crisis.

Are you Danish or American ?, it’s immaterial to me, but your pigeon English is hard to understand…. you ramble incoherently. One thing very apparent is your racism, a vulgar trait usually found in uneducated people unable to express themselves fully. If you took the time to inform yourself in just a few of the basic facts about Russia you’d realise that your diatribe was just that…a meaningless rant. Russia, unlike America, is virtually self-sufficient,It’s the biggest producer of organic foods in the world, it’s effectively debt free carrying an enviable gold reserve. Its resources of precious metals, oil, gas etc etc are almost limitless. As far as your insinuations of rusty weaponry is concerned, it possesses the most highly advanced hypersonic weaponry in the world….decades, if not generations ahead of America. Knowledge is power, but a little knowledge is a very dangerous thing !

Russia probatly has the tallest dwarfs too and will win the next Olympics for Dopermans.

Jenny is durak—russia possesses more natural gas and oil than any other nation, more diamonds mines more gold each year (except 2 other nations), more platinum (except s Africa) imports more wheat than any nation earth, exports vehicles to latin Amerika, India, Indonesia,etc….the US dollar has not been the preferred reserve currency in any nation for a decade.

Russia has a very strong technology and industrial base too. It is also self sufficient in food and hopefully now will focus on domestic production of consumer goods. It graduates more engineers and scientists than any country in the world. The strategy to lower oil prices is paying off as the Americunts and polluting Canadian tarsands are out of business as their cost of production is very high. The Saudis are finished anyway, just look at their “success” in Yemen.

LOL…both gold and silver are lower than before the Pandemic hit. Damn, Silver is the lowest it’s been in 10 years or so. But yes. You’re Ruble is also falling off the cliff, Igor.

Thats right. The limitations are, that other countries do the same thing and the US ones cant be sold.

For now I see it as a 3-4 month crissis and are (as no economist) not worried.

https://assets.bwbx.io/images/users/iqjWHBFdfxIU/iZkLYjoGE.To/v4/-1x-1.png

That nothing compared to Denmark. All do that more or less. That can be a big problem¨, where people has no social security net.

USA have a very thin net, but others hardly has any. Bringing that only says, that USA are able to be seen in graphics.

There most likely will several million unimployed in USA. Its a big country.

Highest ever is not true. After the 1929 collapse it was much higher in %.

it could be worse than 1930—too early to know

the decline in the stand of living and real wages has been steady in the US since 1977 when a family could survive on 1 income—today amerikans can hardly survive on 2 incomes

Tell me about it, in the last 10 years prices have nearly doubled.

The unemployment and economic contraction is beyond the great depression in terms of how quickly it’s come on.

https://upload.wikimedia.org/wikipedia/commons/thumb/0/04/Real_GDP_of_the_United_States_from_1910-1960.svg/1280px-Real_GDP_of_the_United_States_from_1910-1960.svg.png

https://upload.wikimedia.org/wikipedia/commons/thumb/f/f1/US_Unemployment_from_1910-1960.svg/1280px-US_Unemployment_from_1910-1960.svg.png

Just the other month turmp said amerika was doing excellent and amerikans should spend and enjoy themselves.. and it was the best of times..

Jew parasites have bankrupted Americunts, just print more toilet paper money and fan more wars for Jew scum.