Originally appeared at ZeroHedge

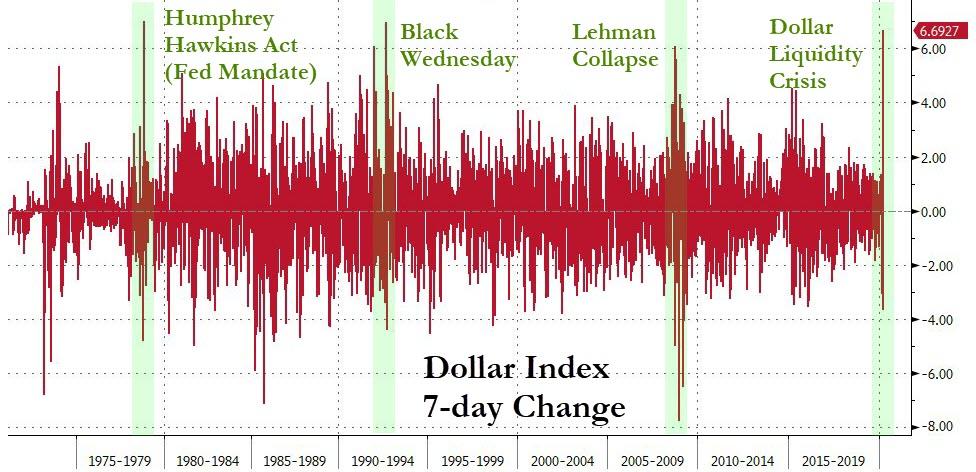

The events of the last several weeks have ominously demonstrated that dollar shortage has returned with a vengeance, as new headaches for virus-battered emerging markets will find it hard to cope with falling local currencies and demand.

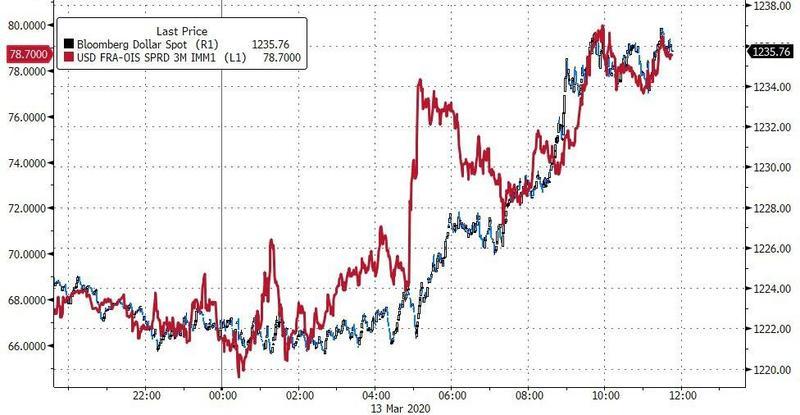

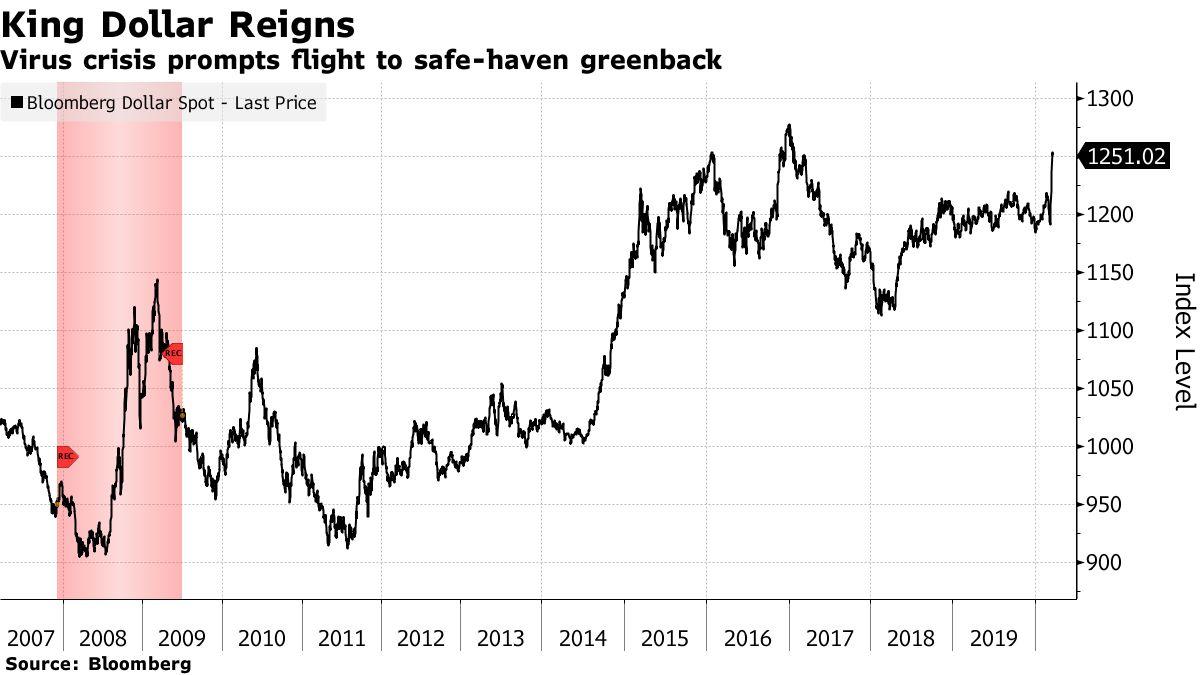

The dollar shortage was confirmed last week in both the Bloomberg Dollar index and the FRA/OIS spread, a closely followed indicator of interbank dollar funding availability that has spiked higher, indicating rising stress.

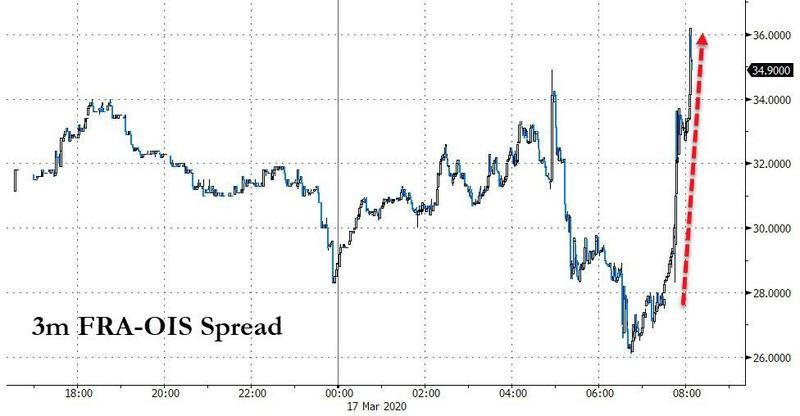

The Federal Reserve’s massive monetary “bazooka” including trillions of dollars for repo markets and the launch of $700 billion QE5 and return to ZIRP, as well as an emergency six POMO operations last week has failed to boost risk sentiment, and the FRA/OIS has yet to show any signs of relief, as it has surged to the highest level since the financial crisis.

The Fed’s monetary cannon may have solved the corporate liquidity crisis for the time being. Still, the dollar/liquidity shortage in the global financial system continues to worsen as investors are dumping emerging markets in record numbers and scrambling for dollars.

Marrying the supply chain disruption triggered by the Covid-19 crisis in China with the oil price war, this has crippled the petrodollar exchange system by sending the price of oil sharply lower and exacerbating the global dollar funding shock.

We’ve pointed out, the world is facing an unprecedented dollar margin call, as a result of the $12 trillion synthetic dollar short, some 60% of US GDP. With the dollar rising, the cost of servicing dollar debt for businesses and governments becomes more expensive as their local currencies plunge amid the barrage of rate cuts by global central banks.

“The surge in the dollar is another blow to emerging markets,” said Mitul Kotecha, senior emerging markets strategist at TD Securities in Singapore.

“The demand for the dollar has outweighed any hit to the US currency from sharply lower Fed rates. EM assets will continue to struggle as investors steer clear of relatively risky assets and maintain a bias for safe havens.”

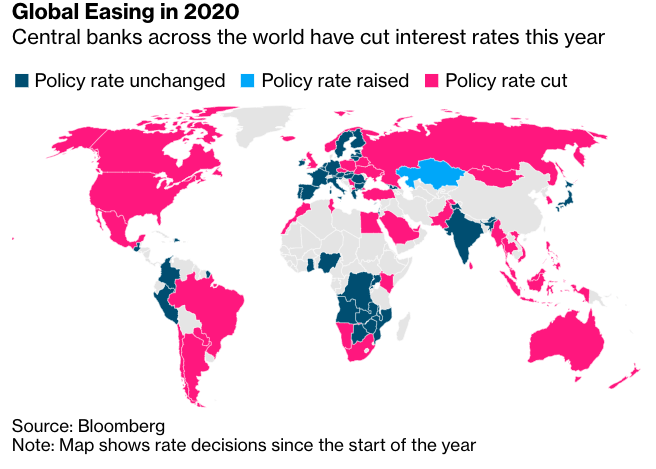

The Fed’s panic rate cuts on Sunday, welcoming the US back to ZIRP, has led to South Korea, Chile, Vietnam, Sri Lanka, Turkey, and Pakistan to cut rates as well. South Africa, Brazil, and Indonesia are expected to slash short-term interest rates later this week.

On top of dollar funding pressures, world trade growth is collapsing, and the tighter financial conditions on emerging markets have triggered a $30 billion outflow in 45 days since the virus crisis started, Bloomberg notes. The dollar reigns supreme in a crashing global economy and pandemic. For instance, the Mexican peso and Russian ruble have dropped by 20%.

Khoon Goh, the Singapore-based head of Asia research at Australia & New Zealand Banking Group Ltd., says emerging market economies are deploying rate cuts to cushion a hard landing but are using FX reserves for currency stabilization.

“They will continue to utilize their FX reserves to smooth currency volatility but will not seek to stem the trend or defend any particular levels,” said Goh.

“In the current environment, when external demand is very weak, allowing some currency weakness alongside lowering interest rates is the best way to try and ease overall financial conditions.”

The Australian dollar has tumbled to its weakest levels since 2003, a move that will increase import costs. Norway’s krone has fallen 15% this year, plunging to an all-time low as Brent tags the 27-handle this week.

Central bankers are making sure dollars continue to flow around the world. The Fed’s Sunday announcement called for reduced rates on its dollar-swap lines with five other central banks, a similar policy seen during the 2008 financial crisis.

“A strong dollar is typically a headwind for emerging-market currencies and even more so for countries that are reliant on offshore dollar funding and have floating exchange-rate regimes,” said Todd Schubert, head of fixed-income research at Bank of Singapore Ltd.

As the dollar shortage continues, tightening financial conditions in emerging markets, it’s only a matter of time before something breaks.