Originally appeared at ZeroHedge

The historic OPEC+ “Mexican Standoff” production cut came and went, and after a very short kneejerk spike higher oil has continued to plunge to historic lows for the two reasons we laid out previously: i) the production cut was not nearly enough to offset the demand collapse of as much as 36 million barrels, and ii) every day that tens of millions of excess barrels are produced brings us one day closer to that catastrophic D-day when oil storage runs out.

Of course, just like not all oil producers are equal – recall Goldman recently predicted that landlocked producers may see oil prices go negative, as they run out of buyers or places where to store the oil, while tanker access to most Brent exporters means that the price of Brent will not drop materially below $20 – not all storage is equal either, and while Cushing and ARA commercial storage is expected to hit full in just a few months at the current rate of net supply, many producers are using water storage as a flexible alternative.

As a result, traders are now storing an estimated record 160 million barrels of oil on ships – double the level from two weeks ago as they seek to tackle a glut of stocks, Reuters reportsas traders have rushed to find storage on land and at sea in what is believed to be the biggest oil glut in history.

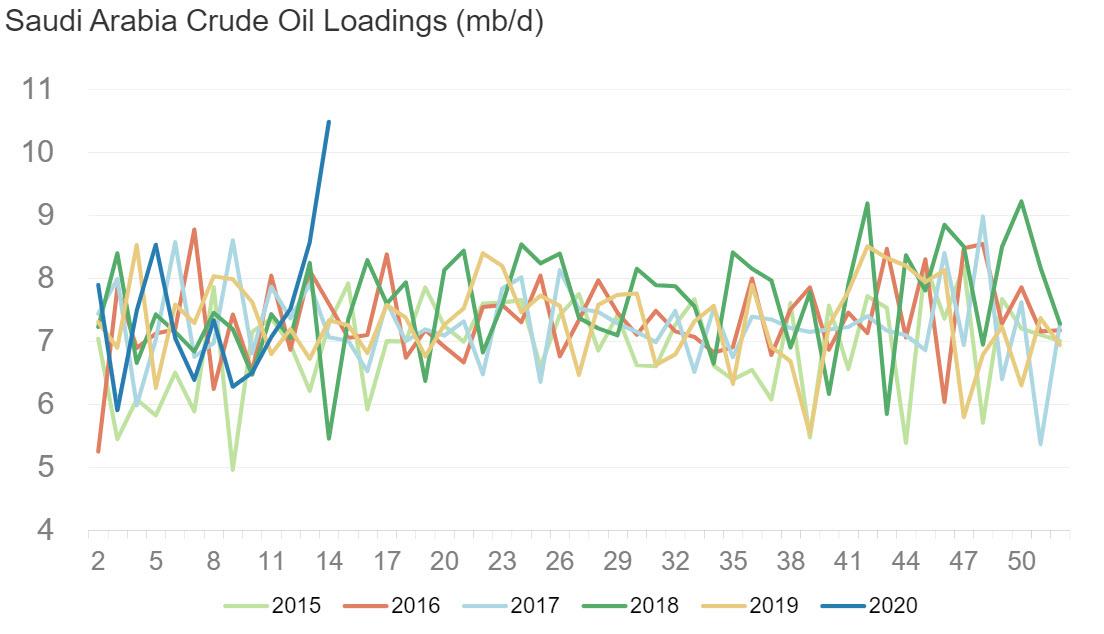

The surge in water storage, which started with Saudi Arabia unleashing an armada of tankers last month to flood the world with cheap oil…

… has swept the globe and shipping sources say oil held in floating storage on tankers had reached at least 160 million barrels including 60 supertankers, aka very large crude carriers (VLCCs), which can each hold 2 million barrels. This compared with just 25 to 40 VLCCs already chartered with storage options at the start of April and fewer than 10 VLCCs in February, the sources said adding that smaller tankers were also being used, which was also boosting volumes being held at anchor.

The last time floating storage reached levels close to this was in 2009, when traders stored over 100 million barrels at sea before offloading stocks; the plunge in oil prices then prompted one of our very first posts in January 2009 “Risk-Free Profit Idea of the Day” in which we explained how to benefit from $25 contango.

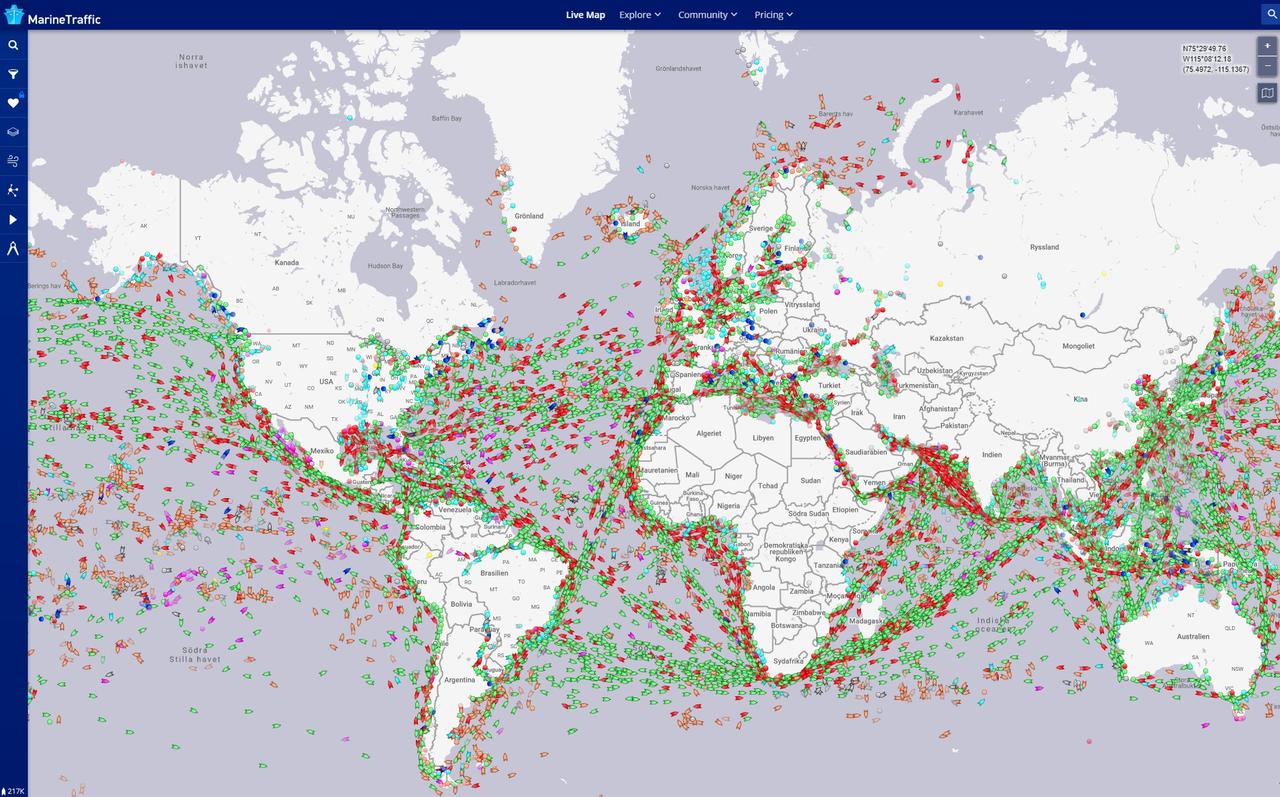

Putting naval oil infrastructure in context, the red dots show oil-tankers transporting over 100 million barrels each day. Now add another 60 million barrels to begin..

Barzanistan (Iraqi Kurdistan) has no storage issues (Ceyhan Pipeline/Terminal), but needs $65/bbl oil to break even on the KRG ‘government’ budget because of all the corruption and grifters. Any oil they do sell has to be heavily discounted because nobody (but Israel) wants the legal headaches from buying Iraqi oil from non-Iraqi entities (KRG). And once again, the KRG has cut production payments to its reluctant producers, UK’s Genel Energy and Norway’s DNO. Who, in turn, are cutting production in ‘Kurdish’ fields. The KRG is about a half-billion USD behind in payments today and still insist on selling below-market-price oil ($15/bbl now?), primarily to Israel (but that’s a secret).

Barzanistan keeps all the money it gets from its Iraqi oil sales, but still demand $400 million/month from Iraq’s budget to run it’s qasi-state (gov’t salaries and welfare payments). They finally agreed to give Iraq back about 250,000 bbl/day of their production if Baghdad sends their share of the monthly budget to Barzanistan. Except the US so thouroughly f’ked up the Iraqi government that there is no budget approved for 2020 and won’t be for a while. Sorry, Barzanistan.

The KRG squirreled away about a billion USD of their ill-gotten oil gains in Lebanese banks, but the US Jihad for Israel destabilized the Lebanese banking system so much that the KRG can’t get their money out – its frozen in the Lebanese banks right now and probably gone. The banks are most likely insolvent – nobody knows. So the KRG is insolvent, can’t make welfare payments or pay government salaries, and stolen oil profits ended with low prices. Which can only mean one thing: time for the US to send ISIS back to Barzanistan to distract Kurds from overthrowing the KRG.