Originally appeared at ZeroHedge

Update: just moments after our write up on how much depends on OPEC+ getting a deal done (including, among other things, Trump’s re-election chances) there was virtual white smoke pouring out of OPEC+’s virtual chimneys, when Bloomberg reported that after a week-long marathon of bilateral talks and four days of video conferences with government ministers from around the world, an “historic” agreement finally emerged to cut oil production in a world suffering an unprecedented plunge in energy demand.

Just hours before oil resumed trading on Sunday, energy ministers of global oil producers agreed to cut oil production but not by the 10MMb/d announced previously, but rather by 9.7MMb/d as Mexico won the long-running standoff, and will be required to only cut 100,000 despite Saudi Arabia’s vocal objections, with the US somehow contributing the balance.

“OPEC+ will cut 9.7 million barrels a day — just below the initial plan of 10 million. Mexico appeared to have won a diplomatic victory as it will only be required to cut 100,000 barrels — less than its pro-rated share”, Bloomberg reported. This means that the 4-day Mexican standoff between Mexico and pretty much every other nation, has ended with Mexico victorious and Saudi Arabia’s reputation to enforce a deal in tatters, in no small part thanks to Mexico’s “secret weapon” a multi-billion oil price put that insulated Mexico from further oil price declines.

This means that in a world where there is now up to 36MMb/d less oil demand, the world’s oil producers have agreed to cut production by… 9.7MMb/d.

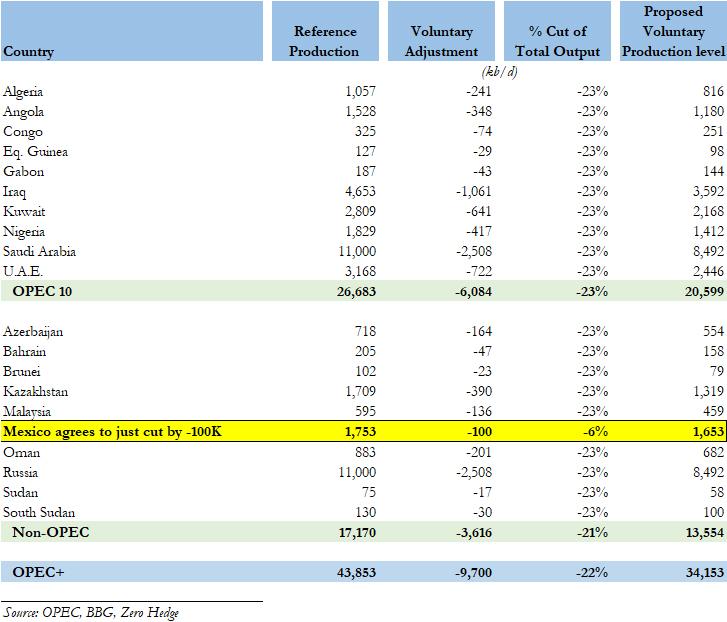

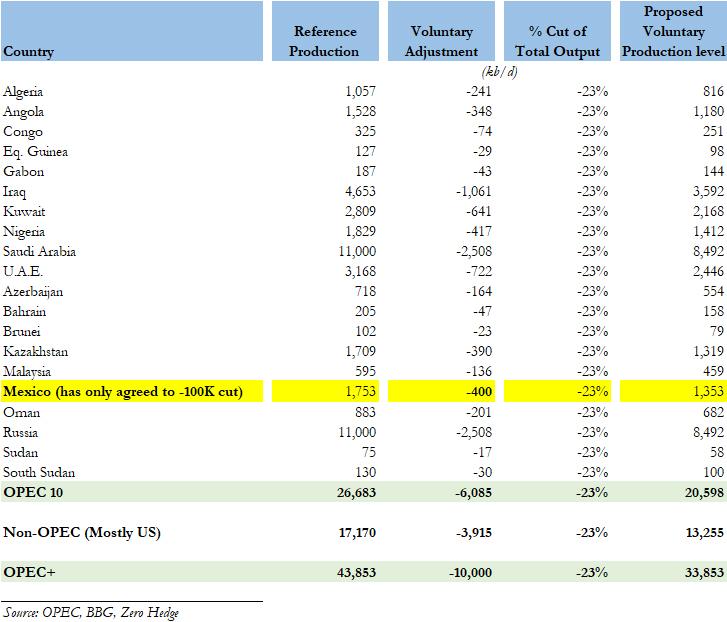

It also means that starting May 1 (obviously no need to rush here at all) the world’s oil production will look like this:

Or rather, it won’t look like that because the table assumes non-OPEC nations – besides Mexico – cut by 23%. That won’t happen, as we now learn that the US will cut 300,000 bps on behalf of Mexico, but not pursue any of its own cut.

And while Bloomberg has blasted the following headline:

- U.S., BRAZIL, CANADA TO CONTRIBUTE 3.7MBD TO OUTPUT REDUCTION

That said, the US will not contribute anything besides offsetting the 300K in Mexican cuts, in the next few months….

- NIGERIA SAYS U.S. PRODUCERS TO CUT 300K B/D AS PART OF OIL DEAL

… as the US position has long been that US output will decline organically by 2mmb/d over the next two years as it is unable to do so from a legal basis. Of course, if oil prices do rebound, none of this decline will ever happen as US shale ramps up again, which means that the US is getting a free pass once again however with the US now the biggest producer, this simply means that today’s deal will be forgotten in weeks if not days.

Additionally, as Bloomberg’s Julian Lee writes, the deal raises some even bigger questions than Mexico. Russia, for example, is to cut its output by 2.5 million barrels a day over the next three weeks. Good luck with that:

Really? Igor Sechin, head of state-controlled oil company Rosneft, was a fierce critic of Russia’s modest contribution to previous reductions. I can imagine how he’ll react when he’s told his company has to cut output by almost 1 million barrels a day by May 1.

The question now for the oil market is whether the cuts will be enough to throw a floor under prices as demand for energy craters. Amid a record plunge in demand, the result of the global economic shutdown, the oil market is now far more worried about consumption than supply. OPEC itself acknowledged the challenge, with its chief warning ministers demand fundamentals were “horrifying.”

OPEC+ was also seeking 5 million barrels a day of output reductions from producers in the Group of 20. The group, however, didn’t mention any curbs in its communique following a meeting on Friday, only saying it would take measures to ensure stability. India’s minister mentioned filling the country’s strategic oil reserve, but there were no concrete new offers from the group. With oil prices on the floor, building up reserves makes sense anyway, and China and India have already started. But storage space is limited.

The U.S. has room for another 77 million barrels in its Strategic Petroleum Reserve, but Congress refused last month to approve the budget for an initial 30-million-barrel purchase. Oil traders and analysts estimate that China could buy an extra 80 million to 100 million barrels this year. Meanwhile, the Indian government is asking state-run refiners to buy 15 million barrels of crude from Saudi Arabia, the United Arab Emirates and Iraq to fill its tanks. Beyond those three countries, there’s little storage capacity elsewhere.

U.S. Energy Secretary Dan Brouillette told the G-20 meeting that the oil market collapse will impose some 2 million barrels a day of American output cuts by the end of the year without any government intervention. Some predictive models, he added, see the drop as big as 3 million barrels. Russia previously rejected such “free market” cuts, arguing that production falling in response to a lack of demand is not an output reduction. But in the end it capitulated, along with the other OPEC+ countries. There was no mention in the OPEC+ communique of the deal being dependent on the actions of anyone else outside the group.

Putting it all together, this means that today marks the second time in less than five years that Saudi Arabia’s attempt to pursue a pump-at-will policy has collapsed. After just one month, this one has lasted an even shorter time than the previous effort, brought to an end by the OPEC+ deal with Russia and other countries toward the end of 2016. Meanwhile, the math is that if one ignores the diplomatic sleight of hand and math gimmicks, the production cuts amount to just over 7mmb/d, which while still a record amount, are hardly enough to put an even modest dent in today’s massively oversupplied market.

Which brings us to Julian Lee’s ominous conclusion: “with an unprecedented demand collapse. Don’t be surprised if the war over market share between the Saudis, the Russians and the Americans resumes once the lockdowns ease and people want oil again. This is probably a temporary truce rather than genuine peace between the three biggest producers.”

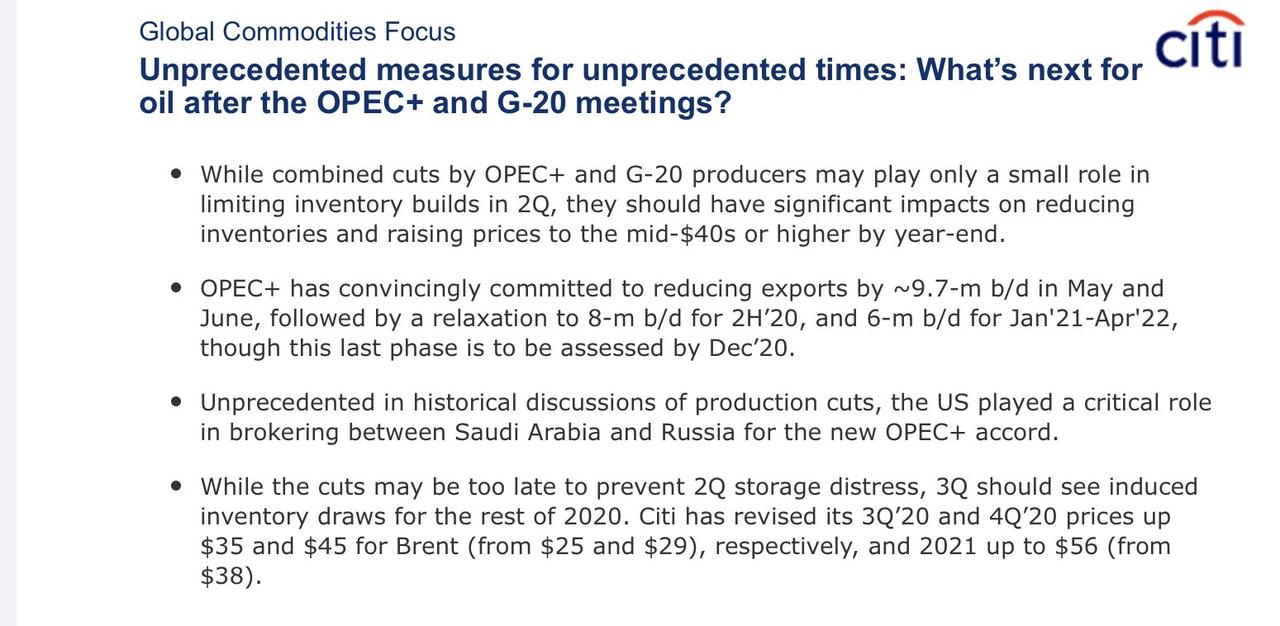

It probably is, but Citi’s Edwards Morse, who moonlights as a special advisor to OPEC, wasted no time in upgarding his oil price from $25 and $29 for Q3 and Q4, to $35 and $45 respectively…

… even as Goldman’s Damie Couravalin expects today’s deal to achieve nothing with Brent set to slide back to $20/barrel.

Given the difficulty for most producers outside of core-OPEC to implement large cuts, an even bigger headline cut at the G20 meeting would not change such an inevitable outcome, as we discussed yesterday.

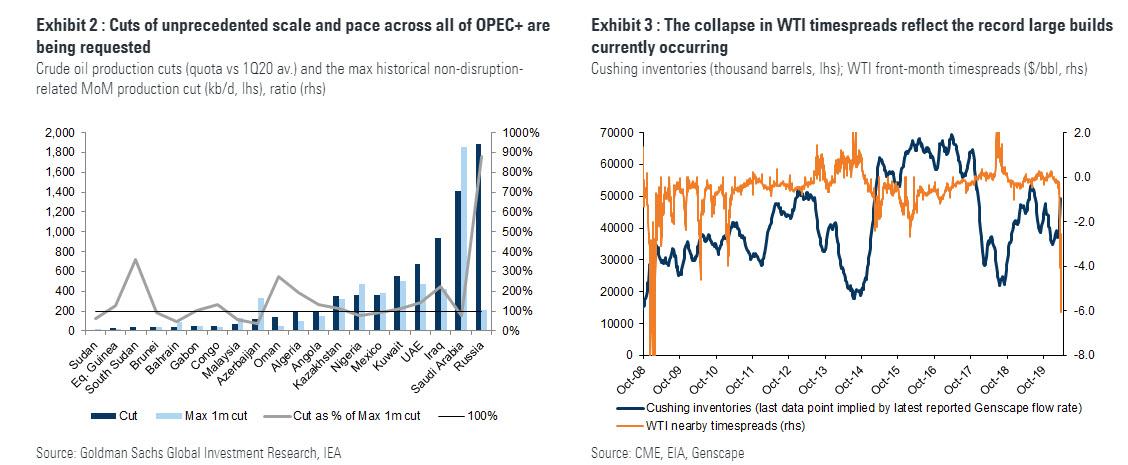

- First, the equitable c. 23% country level cuts used by OPEC+ (instead of the typically higher core-OPEC share) allows for a large headline cut but also implies lower compliance.

- Second, it leaves the effective voluntary cuts too small to avoid breaching storage capacity, ensuring that low oil prices force all producers to contribute to the market rebalancing with some of the shut-ins likely to prove persistent, creating a faster oil rebalancing.

We therefore reiterate our view that such cuts, if agreed upon tomorrow, would still be too little and too late to prevent a decline in prices in coming weeks as storage capacity becomes saturated. Ultimately, this simply reflects that no voluntary cuts could be large enough to offset the 19 mb/d average April-May demand loss due to the coronavirus. Such an outcome was already visible today, with the large Cushing crude inventory build reported by Genscape driving a further collapse in May-June WTI timespreads to -$6.0/bbl. We expect further weakness in WTI timespreads and crude prices in coming weeks, with downside risks to our short-term $20/bbl forecast (especially if a deal is not reached)

One of two will be wrong.

* * *

EARLIER:

Perhaps due to ideological principles, perhaps due to its massive oil hedge that stands to make billions in profits if oil stays at its current depressed prices or drops further, perhaps because Mexico’s president AMLO plans to revive Pemex and so is unable to cut oil output, but four days after OPEC+ announced it had “reached a deal” in which all oil producing nations, including non-OPEC G-20 members would cut production by 23%, Mexico is still refusing to sign the dotted line and is threatening to trigger another oil price crash when the black gold reopens for trading in a few hours.

To be sure, there were some signs of progress with Bloomberg reporting that as diplomatic wrangling between Mexico and Saudi Arabia entered a fourth day, a group of OPEC+ ministers were due to speak at 5 p.m. London time and delegates said two possible fixes would be discussed. However, as Energy Intel deputy bureau chief Amena Bakr, writes, almost an hour after the scheduled call, Mexico’s energy minister Rocio Nahle had yet to join the call.

Sources say that Mexico’s minister isn’t on the call yet #OOTT #opec

— Amena Bakr (@Amena__Bakr) April 12, 2020

And as the world wait, the stakes are getting higher by the hour: oil prices have already collapsing under the weight of an oil glut that amounts to about a third of the market’s overall size, as the coronavirus pandemic has shut down the global economy and sent India’s oil demand plunging 70%. That’s threatening the U.S. shale industry, wrecking the budgets of oil-dependent nations and making it harder for central banks to respond to the virus shock; it has also made Trump an especially activist participant in this negotiation which he is hoping works out as Trump knows very well that without Texas his reelection odds will follow the price of oil.

That has not escaped the Kremlin, which earlier today warned of “unmanageable chaos” if negotiations fail. “The whole world needs this deal,” Dmitry Peskov, spokesman of President Vladimir Putin, said in comments broadcast on Sunday, while also hinting that Trump may have the most to lose if a deal is not reached: “With layoffs looming for the U.S. oil industry and shale oil companies on the brink of bankruptcy, the nosedive in crude prices acquires political significance as U.S. elections approach”, Peskov added ominously.

The OPEC+ alliance on Thursday agreed a plan to cut its output by 23%, or 10 million barrels a day, equal to a 10th of global supply. The deal would end the month-long price war between Saudi Arabia and Russia. However, it still needs the approval of Mexico, which is part of the alliance, but until Sunday had yet to endorse it. Mexico has agreed to cut just

On Sunday’s call delegates expected a compromise solution proposed by President Donald Trump last week – initially rejected by Saudi Arabia – would be discussed again. Another idea has also emerged, to focus on Mexico’s exports rather than production. Negotiations then escalated to the highest level, with Trump intervening to speak to leaders including Crown Prince Mohammed bin Salman.

Late last week, a deal looked close until Mexico raised objections. Populist president Andres Manuel Lopez Obrador has pledged to restore his country’s oil-pumping prowess with its politically symbolic state oil firm, and so he is reluctant to cut output. Trump offered a compromise – by which U.S. cuts would count as Mexican – but it was rejected by Saudi Arabia. Talks between the kingdom and Mexico continued through the weekend as no a single nation was willing to back down from the Mexican standoff.

Confirming that Trump is especially invested in getting some deal done today, in an attempt to break the impasse, the US president offered a diplomatic solution that includes some “creative accounting” with Mexico counting some of the U.S. market-driven supply decline as its own. According to delegates, most OPEC+ countries back the Trump compromise – even if they acknowledge it’s a face-saving mechanism that doesn’t translate into actual cuts. But Saudi Arabia insisted that Mexico cut its production as much as everyone else.

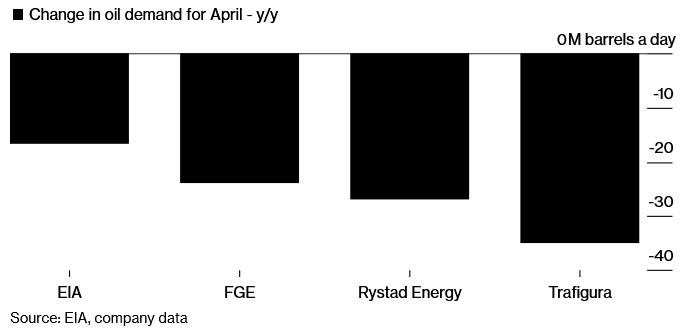

That said, even if a deal is reached – and one likely will be – it may not be enough to put a floor under oil prices. While a 10% reduction in worldwide crude output would be unprecedented, it would barely dent the surplus that continues to build and has reached as much as 36 mmb/d of global demand according to Trafigura.

Needless to say, traders will inspect any agreement for details of where real cuts are coming from, and how much of the headline figure might come from moving baselines and reductions that have already been forced on producers by the market.

On Friday, G-20 nations followed the OPEC+ meeting and said they would take “all the necessary measures” to maintain a balance between oil producers and consumers, but made no commitment toward specific steps on production cuts.

Riyadh had wanted the G-20 meeting to yield at least 5 million barrels a day of cut commitments from producers outside OPEC+, however it is now clear that the only production cuts the US is willing to shoulder – besides what the administration has defined as organic cuts over the next two years as some 2mmb/d in shale production are eliminated – are those to backstop Mexico. The reality, as shown in the table above, is that real cuts when ignoring accounting gimmicks, amount to just over 7mmb/d, still a record amount, but hardly enough to put an even modest dent in today’s massively oversupplied market.