Written by Evgeny Satanovsky; Originally appeared at VPK, translated by AlexD exclusively for SouthFront

It is unlikely the relations between the Russian Federation and Turkey, regardless of the good intentions demonstrated by both parties, will return to the state prior to the Fall of 2015 when Moscow and Ankara’s interests collided head-on in Syria.

The decision to down the Russian fighter jet was a move designed to demonstrate the unhappiness of R.T. Erdogan for the destruction of his plans. Today this crisis is overcome, at least formally. As a result of the collapse of several areas of the Turkish economy, domestic and foreign political problems as well as security, the Turkish president is forced to try to improve relations with Russia and Israel. The leadership of the Russian Federation agreed to meet, but as much as we can understand, the relations with Turkey will be built on the basis of pragmatic calculations, lacking the confidence that Ankara has lost.

The negotiations between Presidents Putin and Erdogan on August 9 in St Petersburg caused a flurry of commentaries in the West and were devoted (at least in the public sphere) to the restoration of economic relations of the two countries. Let us look at the results, basing on the material from the expert of the Institute of the Near East Studies, E.O. Kasaiev, prepared for the institute and dedicated to one of the main topics of the two-sided meeting of the highest level: the renewal of the “Turkish Stream” project. The format of the talks that were attended by ministers and heads of state-owned companies from both sides, contributed to this. The results of prior negotiations caused commentaries from many observers, including at the highest level, indicating the impact this project will have on the energy supply system to Europe if it is built.

From branch to branch

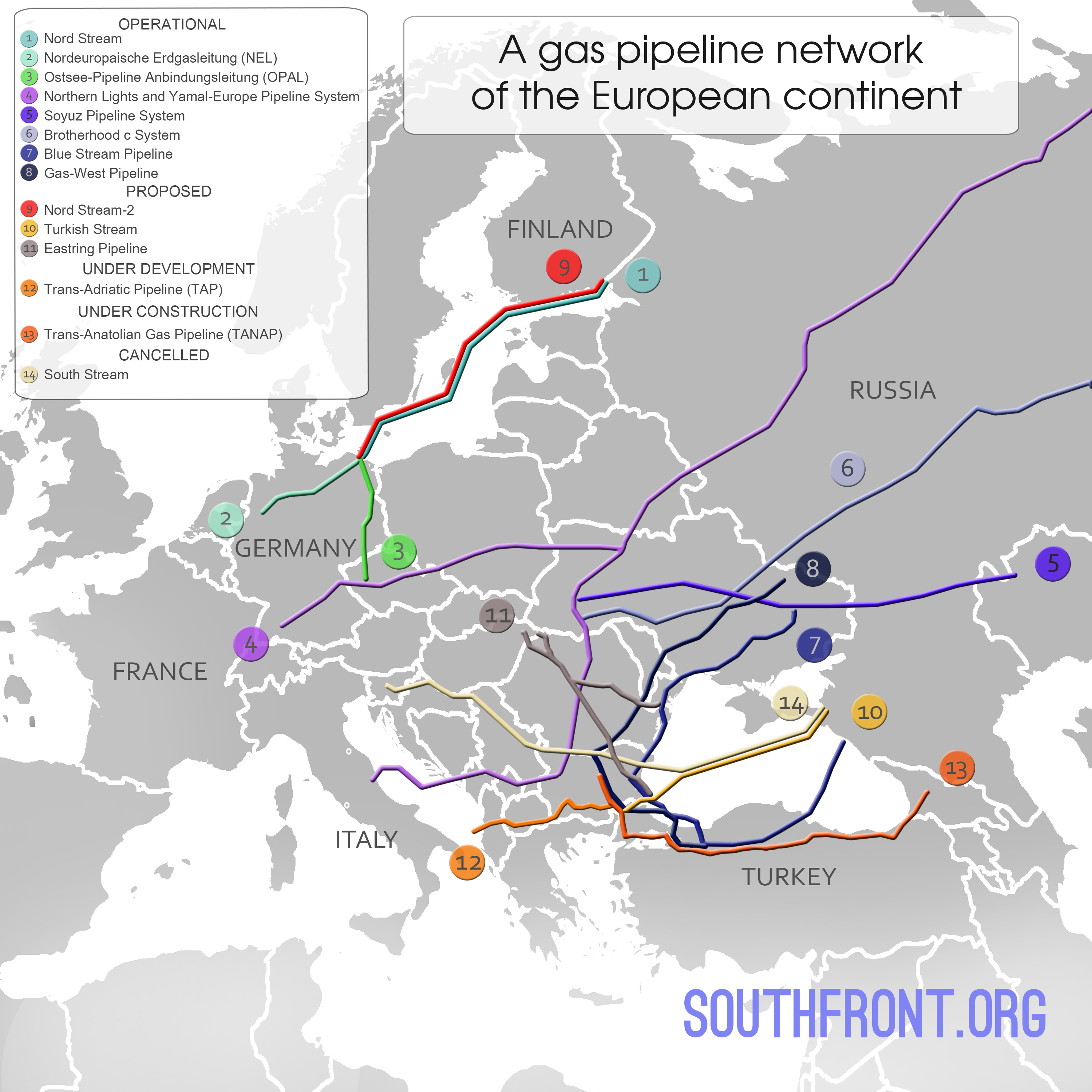

The construction of the gas pipeline project “Turkish Stream” was conceived in December 2014 in response to the EU’s obstruction of the construction project of the “South Stream” pipeline which was supposed to be laid on the bottom of the Black Sea from the Anapa district of the Bulgarian port Varna. The planned line from Russia into Turkey was supposed to consist of four streams (as the “South Stream”) with a capacity of up to 63 billion cubic metres per year. A quarter of the natural gas was intended for Turkey, the remaining amount was to be transported to the German border, from where it was supposed to be taken by consumers in Southern Europe. By Gasprom’s assessments, the total cost of the installation of the four streams amounted approximately 11.4 billion Euros.

Following the downing in November of last year of the Russian bomber SU-24 in Syria by the Turkish Air Force, with the cooling of relations between Moscow and Ankara, the project was frozen. In the period of aggravated relations Ankara officially stated that Turkey would dispense with the Russian blue fuel, although Gasprom’s deliveries supply approximately 60 percent of the Turkish gas market needs. In June, Erdogan officially apologised for the incident. Later in Ankara, there were talks of resuming the project.

The “Turkish Stream” is already prepared on the Russian side in its practical implementation: in Russia, the infrastructure is ready for the supply of the gas into the line, the pipes are bought for the maritime section and the contracts for the construction are signed. The Russian side sent the intergovernmental agreement project to Ankara before the political falling out. However, the project configuration has undergone a change: from four lines, each 900 kilometres were reduced to two. Each one of them has to have a capacity of 15.75 billion cubic metres per year for the Turkish market and southern Europe. From the border with Turkey the line presumably will continue the projected gas pipeline “Poseidon” through Greece and the Ionian Sea to the south of Italy.

It is important to receive from the Turkish side the approval of a section of the agreement. The intergovernmental agreement signed by Ankara is missing as well. According to Erdogan, his country wants to assume half the costs of the construction of its section of the gas pipeline. In this case, it is vital to change restrictions entered against them by the Russian Federation to attract construction workers from Turkey. Characteristically, on the eve of Putin and Erdogan’s meeting, Bulgaria renewed its interest in the resumption of work on the “South Stream” project. Following the advice of the European Commission, Sofia lost approximately 400 million Euros per year from the transit of the raw material. However Russia has not received from them the guarantee for the resumption of work.

At the end of the meeting of the two leaders in St Petersburg, the Minister of Energy of the Russian Federation Aleksandr Novak said that realistically the laying of the first branch of the “Turkish Stream” would be completed in the second half of 2019. According to him, the intergovernmental agreement can be signed in October. In his turn, the head of Gasprom Aleksey Miller declared that the company is conducting negotiations with their Turkish partners on this project.

On August 15 the head of the Ministry of Foreign Affairs of Turkey, M. Chavushoglu suggested to connect this line to the Trans-Anatolian Natural Gas Pipeline (TANAP), which, according to plans, will have Azerbaijani gas flowing to Europe in the “Southern Gas Corridor” project, connecting with the TANAP and TAP (Trans-Adriatic Pipeline) lines, the source being the gas field “Shah Deniz” with a reservoir of approximately 1.2 trillion cubic metres. According to Chavushoglu, with the help of the “Turkish Stream” the country will buy each year 16 billion cubic metres of Russian gas for the domestic market. The remaining volumes can be exported through the TANAP.

On that line, an additional 1850 kilometres of pipes are planned, delivering six billion cubic metres of gas per year for the domestic market by 2018 and ten billion cubic metres for transit to Europe for the beginning of 2020. The cost of the project is estimated at 9.3 to 11 billion dollars. The TAP with a length of 882 kilometres and an initial throughput capacity of 10 billion cubic metres per year must take the gas from the “Shah Deniz-2” gas fields to the TANAP line on the border of Greece and Turkey. The gas pipeline must cut through the Balkans, Adriatic Sea and southern Italy and enter into the Italian Snam network. The cost of the project is 5.6 billion Euros. Greece, Albania and Italy have signed in 2012 the agreement for the construction of the TAP.

Evaluating the “Turkish Stream” project, it is worth mentioning that it can balance the 20-year old system of gas routes through the Turkish and European Union territories, which cause intense reactions in several countries, namely Belarus, Poland and the Ukraine to Georgia, Iran and Azerbaijan.

A modest export from Iran

On the one hand, the “Turkish Stream” will complicate the Iranian entry into the natural gas European market. On the other, it can strengthen the interest of Western governments in Iranian fuel as an alternative. Since 2014 the EU has expressed its interest in it. The Iranian authorities declared that they are ready to export gas to Europe through the “Nabucco” pipeline. The USA proposed to Iran to join the TANAP system. Thus in 2015 the production level of gas in Iran reached 192.5 billion cubic metres (in Russia it was 573.3 billion cubic metres). In 2015, Iran sold 8.3 billion cubic metres, of which 7.8 billion to Turkey (in 2014, it was 8.9 billion), and 0.5 billion cubic metres to Armenia (in 2014, it was 0.7 billion). From January to May 2016, Iran exported to Turkey 3.35 billion cubic metres. Its share in the Turkish gas import in these past five months amounted to 16.79 percent.

Turkey, regardless of the construction of the “Southern Gas Corridor” and the renewal of the supply project from Russia, plans to intensify the import of the blue fuel from the Islamic Republic. Teheran and Ankara do not publish the price for gas but according to some information, it is about 480 dollars for one thousand cubic metres. The Russian raw material costs one and a half times cheaper. Iran, until recently, did not agree to provide their Turkish clients discounts, as does Gasprom. Turkey has won the lawsuit in the International Court of Arbitration to receive discounts on Iranian gas, bought in 2011. The plaintiff asked for a compensation of 35.5 percent of the current price and to receive it in monetary equivalency or additional supplies of the raw material.

It seems that in the short term Iran will not be able to seriously increase the delivery of gas to Turkey. The majority of fields in the Islamic Republic are situated in the south. The existing system of gas lines does not always provide the delivery even of the contracted amount, when the demand increases in the IRI itself. The capacity of the “Iran-Turkey” lines consists of 14 billion cubic metres per year, but for an extension of the network, neither Teheran nor Ankara have the funds. There are high risks of terrorist acts since the pipeline passes through Kurdish territories.

In 2015 Iran proposed to transport Azerbaijani and Turkmeni gas through its territory into Turkey and distant EU, although that project will unlikely be supported by Azerbaijan because of Iran’s position in the Karabakh conflict, in which Teheran is formally neutral, but seriously respects the position of Yerevan.

Baku does not see the risks

Azerbaijan, developing the “Shah Deniz-2” deposit, is one of the main investors and major participant in the construction of the transport infrastructure for gas exports to the EU. The cost of implementing the “Southern Gas Corridor” is approximately 13 billion dollars. The beginning of deliveries of raw materials from the “Shah Deniz-2” is slated for 2018. The main deliveries will enter the European market in an unclear price environment and the uncertainty behind it. Thus Baku does not look at the “Turkish Stream” as a serious threat to its gas strategy.

Baku believes that if the underwater part of the pipeline passes in parallel with the “Blue Stream”, there will be a technical possibility of deliveries of Russian gas through the TANAP pipeline, which will secure its required load and will reduce the payback period. As the Director of International Relations of the National Iranian Gas Company (NIGC) A. Ramezani mentioned, the Islamic Republic, having Western sanctions lifted earlier this year, could have used Russian-developed “Turkish Stream” pipeline for the delivery of its gas to Europe if this line was deemed most appropriate for Iran.

The double-sided gas transport project between Russia and Turkey is obviously not in the interests of Georgia. It stays on the sidelines of the blue fuel transit and from appropriate revenues, which are important in the deteriorating economy and social position of the country. In 2015 the Georgian centre of global research held a conference dedicated to the “Turkish Stream”. Politicians and experts criticised the authorities for not trying to connect to the Russian-Turkish project with the given national interests.

Slavic Transit

Kiev is against the “Turkish Stream”. According to the head of the Ministry of Foreign Affairs of the Ukraine Pavlo Klimkin, the warming of relations between the Russian Federation and Turkey will not worsen the relations of Kiev and Ankara, but if the “Turkish Stream” will be implemented, all of Europe will lose, not only the Ukraine. According to him, Russia wants to create on the Turkish territory a gas hub, which will not fall under European laws. Meanwhile, a significant amount of Russian blue fuel flows through the Trans-Balkan gas pipelines through the Ukraine to the Turkish market.

It should be noted that the Ukraine speaks not only against the “Turkish”, but also against the “Nord Stream-2”, on which Russian gas it is assumed will be transported on the bottom of the Baltic Sea to Germany and from there to other European countries.

At the end of June, the Polish Office of Competition and Consumers (UOKiK, local anti-monopoly regulator) also came forward against the creation of the joint venture between Gasprom and five European companies (for the construction and management of the “Nord Stream-2” pipeline). Information appeared on August 12 that the potential participants of the project (Gasprom, Engie, OMV, Royal Dutch Shell, Unipe and Wintershall) have refused to create the consortium. But realizing that in the long run Europe requires uninterrupted supply of vast quantities of natural gas at reasonable prices, Gasprom most likely will continue negotiations with the Europeans on the prospects of the “Nord Stream-2”. The prognosis is that the demand for natural gas in Europe by 2030 will grow to about 150 billion cubic metres.

The transit agreement with Moscow on the supply of Russian gas to Europe expires at the end of 2019, for which the Ukraine receives approximately two billion dollars. With the loss of this revenue the economic situation in the country will be critical. Kiev will not have the means to quench western creditors. If they launch the “Turkish Stream”, fully load “Nord” and build the “Nord-2”, the Ukraine will lose the transit status. According to data from “Ukrtransgas”, in 2015 67.1 billion cubic metres of Russian gas was transported (8% more than in 2014), of which 64.2 billion cubic metres were for the EU countries and 2.9 billion cubic metres for Moldova.

As for Belarus, there, experts believe the rejection of the “South Stream” as a defeat of Russia in Europe and the “Turkish Stream” as an instrument of pressure on the transit countries. Minsk believes that in the conditions of confrontation between the Russian Federation and the West Belarus’ role as mediator will be required, it will become the centre of decision-making in Eastern Europe, the importance of transit will increase and it is not excluded the construction of the second stage of “Yamal-Europe” pipeline. Fortunately Gasprom owns 100 percent “Beltransgas”, bought for five billion dollars and the gas pipeline “Yamal-Europe”, passing through Belarusian territory. Russia loads Belarusian pipes to full capacity (over 45 million cubic metres), therefore, to increase the flow it is necessary to build a new line.

It should be noted that “Yamal-Europe”, transnational export pipeline, in operation since 1999, links gas fields of the Northern Western Siberia with customers in Europe. It starts in the gas transit node in Torzhok (Tver province) and passes on the territory of the Russian Federation, Belarus, Poland and Germany. The final compressor station in the West is “Malnov” in the Frankfurt an der Oder district, close to the German-Polish borders.

The new gas infrastructure, built by the Russian Federation, will provide Belarus not only additional tax revenues to the budget and investments, but a chance to use the gas pipeline as leverage on Moscow as in the Ukrainian example. From the beginning of 2016, Minsk is seeking a lowering of prices on the Russian blue fuel. Belarus considers it normal to pay on the principle of equal profitability of supplies to Europe against the collapse of gas prices in the EU. However, in case of a price increase Minsk wants to keep the right to return to the old price, the cost of the gas in Yamal plus the transit fees. Russia decided to cut the export of oil to Belarus in the third quarter from 5.3 million tons to 3.5 million. In July Aleksandr Novak gave us the reason that this is done in connection with the incomplete payment by Belarusian consumers of Russian gas.

There is no consent

Regardless of the promises of Ankara, to finance half of the construction of the “Turkish Stream”, before starting the work Russia must receive the necessary packet of documents, including intergovernmental agreements, verify the route and the number of branches of the line. If Turkey agrees to the construction of one branch, having the capacity, sufficient for covering at least her needs, the project will be unprofitable for Gasprom. It is not necessary for Moscow to provide Turkish companies discounts on gas before receiving the signed documents from Ankara.

The project is not to the advantage of Bulgaria, which loses the current and potential transit fees. Sofia tries to save its status and transit revenues by reanimating the “South Stream”. However its financial resources for the construction of the pipeline are limited.

The resumption of negotiations on the “Turkish Stream” makes Kiev nervous. With the help of this pipeline, Russia will bypass the Ukraine, but a compromise is possible. Theoretically the Ukrainian gas transportation system (GTS) is required as an emergency backup for pumping gas to the EU. Obviously the Ukrainians will insist on the extension of the transit contract with Gasprom. The commissioning of the construction of the Russo-Turkish line could be indirectly beneficial to the Ukraine, who stopped buying Russian gas directly since the fall of 2015. Additional volumes of the raw material on the EU market will lower the prices of the Russian gas, purchased by Kiev in reverse from European suppliers.

It is unlikely that Belarus will convince Russia of the necessity to expand the existing gas transportation capacities. She is moving closer to the West and the expansion of export infrastructure through her territories entails risks for Gasprom. The aggravation of relations with Russia in the oil sphere also affects the situation.

Georgia is aware of the feasibility of its participation in the realisation of the “Turkish Stream” but there is a small probability that it will be a reliable partner for the Russian Federation.

For Iran it is more lucrative to come to an agreement with Turkey on the construction of the essential infrastructure for the export of its gas to Europe instead of joining the “Turkish Stream”.

The latter is a competitor for the “South Gas Corridor” which is being built with the participation of Azerbaijan. The entry into exploitation of the Russo-Turkish pipeline will lower the competitiveness of Azerbaijani gas on the European market.

The EU will bet on the TANAP and TAP projects to replace Russian gas with Azerbaijani. In the long term, Iran could be the resource base for the “Southern Gas Corridor”.

Evgeny Satanovsky, President of the Middle East Institute