Written by David Stockman; Originally appeared at Davidstockmanscontracorner

Talk about not waiting for the body to get cold. The establishment oracles are out in force today proclaiming that Brexit has already been cancelled. Apparently, like in the case of the first negative vote on TARP, two days of currency and stock market turmoil have taught the rubes who voted for it the errors of their ways.

The argument is that the unwashed masses outside of Greater London have shot themselves in the foot economically based on some atavistic fears of immigrants and cultural globalization. Racism even.

But those are just momentary emotional outbursts. Right soon they will get back to where their bread is buttered, and demand a second referendum in order to re-board the EU’s purported economic gravy train.

Thus, Gideon Rachman, one of the Financial Times’ numerous globalist scolds, professed that his depression about the Brexit vote has already given way to a worldly vision of relief:

But then, belatedly, I realised that I have seen this film before. I know how it ends. And it does not end with the UK leaving Europe.

Any long-term observer of the EU should be familiar with the shock referendum result. In 1992 the Danes voted to reject the Maastricht treaty. The Irish voted to reject both the Nice treaty in 2001 and the Lisbon treaty in 2008.

And what happened in each case? The EU rolled ever onwards. The Danes and the Irish were granted some concessions by their EU partners. They staged a second referendum. And the second time around they voted to accept the treaty. So why, knowing this history, should anyone believe that Britain’s referendum decision is definitive?

But of course Rachman’s dismissive meme is exactly why Brexit happened. The international financial apparatchiks, who have been controlling the levers of power at the central banks, finance ministries and supra-national official institutions for several decades now, have become so accustomed to not taking no for an answer that they can’t see the handwriting on the wall.

To wit, the rubes are feed up and are not going to take it anymore. In voting to flee the domineering EU superstate domiciled in Brussels, they saw right through and properly dismissed the establishment’s scary bedtime stories about the economic costs.

After all, the UK is a net payer of $10 billion per year in taxes into the EU budget and gets an economically wasteful dose of continental style regulatory dirigisme in return. And that is to say nothing of the loss of control at its borders and the de facto devolution of its law-making powers and judicial functions to unelected EU bureaucracies.

At the same time, increased trade is generally a benefit, but it is not one that requires putting up with the statist tyranny of the EU. That’s because the EU-27, and especially Germany, need the UK market for their exports far more than the other way around.

So after Brexit is triggered, the EU will come to the table for a new trade arrangement with the UK because these faltering socialist economies desperately need the exports. At the same time, the British negotiators will be free for the first time to seek more advantageous trade arrangements with the US, Canada, Australia and others.

It doesn’t take too much investigation to see that the UK has come out on the short end of the trade stick. And contrary to globalist apologists——-persistent and deepening trade deficits are a big problem. If coupled with a weakening savings rate, they mean that a country is getting ever deeper into international debt.

The UK economy exhibits that dual disability to a fare-the-well. Its current account has been plunging further into the red for 20 years. At 5% of GDP its current account deficit—-which includes the favorable benefits of service exports from the City of London and earnings on foreign investments—-is among the highest in the DM world.

To put it bluntly, the UK is slowly going bankrupt.

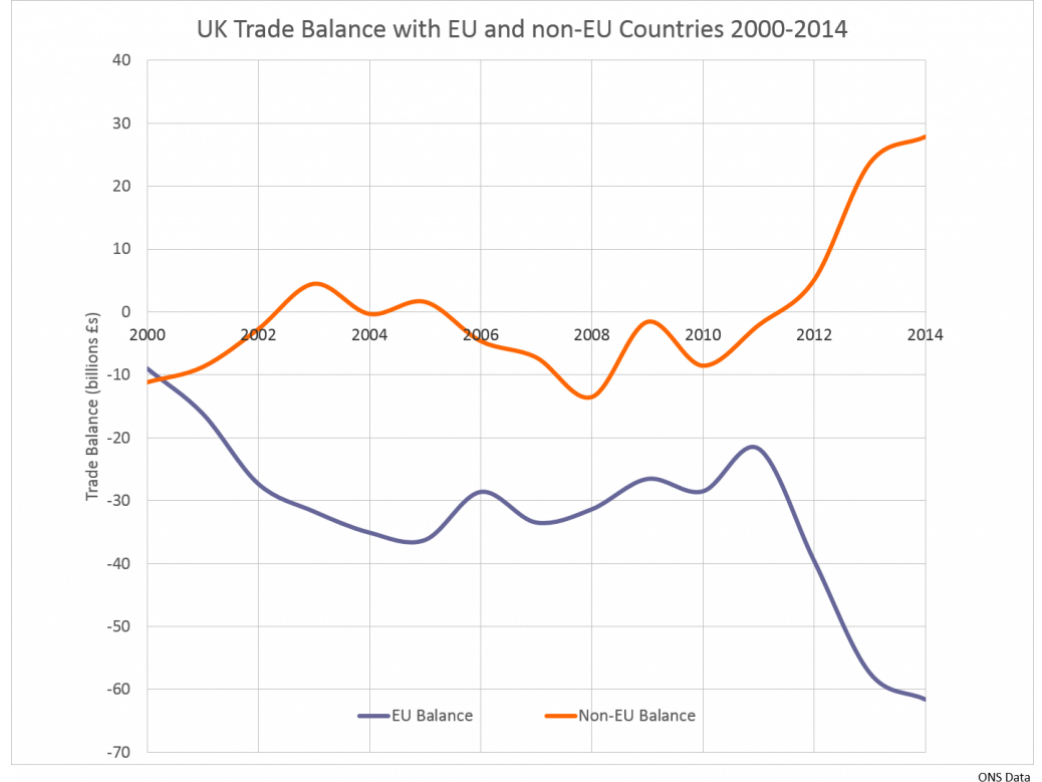

Moreover, the source of the abysmal overall current account trend shown above is absolutely attributable to its one-sided trade imbalance with the EU-27. As shown in the graph below, its EU deficit has been widening ever since 2000, while its trade surplus with the rest of the world has actually been steadily growing.

This point is not about mercantilism. The bilateral balance with any particular country or trading bloc does not ultimately matter if the overall current account trend is healthy.

Instead, the point is that the EU-27 needs British markets to the tune of a net $65 billion surplus annually. And more than half of that surplus is attributable to Germany, which earns upwards of 40% of its trade surplus with the rest of the EU from the UK.

Continuation of an open trade arrangement, therefore, does not require the sacrifice of British democracy and home rule to the statist overlords of Brussels; it only requires a trade deal that provides mutual economic benefits and no entangling engagements with the socialist infrastructure of the continent.

These negative trade trends are not ameliorated by a domestic savings frenzy that could finance the outflow in a healthy manner. To the contrary, the British household savings rate has been heading dangerously south for the last quarter-century.

Domestic savers are not financing the UK’s current account; foreign lenders and central banks are.

The same is true of the public sector. The UK has run chronic, deep budget deficits since the early 1990s. Since then, its public debt to GDP ratio has soared from 35% to nearly 85%.

These data make crystal clear, of course, that the UK has a giant problem of living far beyond its means, and that all of the leftist kvetching about the conservative government’s so-called “austerity” policies is a lot of political balderdash.

In fact, the Cameron government has buried British taxpayers in debt, even as it proclaimed its adherence to fiscal rectitude. As is evident from the chart, the only reduction in the spending share of GDP on its watch is due to the end of the global recession. At nearly 44%, state outlays still take a larger share of the economic production than they did under the Labour governments which preceded.

Here’s the point. Staying in the EU can not help ameliorate the UK’s real economic and fiscal problems in the slightest. What it needs is lower taxes, less welfare, and a dramatic reduction of government regulatory intervention. These are not policy directions that stir the juices in Brussels.

So today’s noisy meme that the Brexit voters have done themselves irreparable economic harm is patent nonsense. By contrast, whether they fully understood it or not, they have liberated the UK from what will be the economic disaster of “more Europe”.

Indeed, if there ever was a phrase that encapsulated the idea of an incendiary contradiction, “more Europe” is surely it. What it means to the French and Mediterranean Left is debt mutualization and a common treasury from which to expropriate German prosperity.

By contrast, to the Germans it means the imposition of ever more onerous EU fiscal controls so that it can continue to kick the can of its giant liabilities for the EU bailouts and the ECB’s “Target2” balances down the road.

These German exposures are enormous——with upwards of $75 billion already drawn on the ESM and EFSF bailout funds and Target2 balances of $700 billion at the present time.

Indeed, the latter is a ticking financial bomb and the real reason that Germany’s historic monetary orthodoxy has given way to Draghi’s money printing madness. To wit, Germany cannot afford to permit the euro and ECB’s central banking system to blow-up.

As a consequence, Germany has acquiesced in an insane fiscal transfer system conducted by the ECB in the guise of monetary policy.

But Draghi’s $90 billion per month rate of QE purchases is really not about “low-flation”, private sector credit stimulation, job growth or any of the other macroeconomic variables, anyway. To the contrary, its not so hidden purpose is to flat-out monetize the debt of Italy, Spain, Greece, Portugal, France and the rest of the bankrupts at negligible interest rates, thereby gifting them with deeply subsidized cost of carry on their massive public debts.

Needless to say, these Draghi confected bond rates could never be remotely attained in an honest bond market. Yet they are absolutely necessary to maintain the charade of fiscal solvency in these woebegone practitioners of welfare state socialism.

So the doomsday machine rolls on. Currently Greece’s Target2 balance is negative $100 billion, while Spain’s is negative $325 billion and Italy’s is negative $300 billion. In short, the rest of the EU-18 owes Germany so much that permitting any country to leave is unthinkable in Berlin.

The call for “more Europe”, therefore, does not arise from cosmopolitan enlightenment, as the mainstream media avers; it is a desperate gambit to keep alive an utterly flawed and contradiction-ridden monetary, fiscal and political union that never should have been concocted in the first place, and that is now several decades past its “sell by” date.

By the same token, the forces of Brexit and their populist counterparts throughout the continent are not simply an instance of the rubes venting nationalistic, xenophobic, racist and other dark impulses. To the contrary, the rubes simply want their governments back, and in that impulse they are on the right side of history.

The truth is, it is the “European Project” which represents the darker impulses. The Brussels/Frankfurt rule of the financial elite has little to do with free trade or the maintenance of peaceful relationships among the states of Europe, and nothing at all to do with furthering capitalist prosperity.

Instead, it is a tyranny based on a muddled brew of globalism, statism, financialization and the cult of central banking. It’s days are numbered because even the rubes can see that it doesn’t work, and that its massive internal contradictions are heading for a spectacular implosion.

The British voters have decided to get out of harms’ way. Hopefully, there will soon be many other cases of the rubes in revolt.