Originally published by ZeroHedge

For much of the past year (and certainly at the time, more than a year ago, when the so-called experts, central bankers and macrotourists were still yapping about “transitory inflation” and other things they were wrong about and do not understand), we were warning that at some point the Fed will realize that it is simply impossible to contain supply-driven inflation through stubborn rate hikes which instead would lead to a dire alternative – millions in mass layoffs and newly unemployed workers …

3 mass layoff announcements in the past 3 hours, meanwhile 12 hikes priced in through February. pic.twitter.com/7Q4wfP9J79

— zerohedge (@zerohedge) June 14, 2022

… and will revise its 2% inflation target higher, a move which will send every risk asset – from high-beta trash and meme stonks, to blue-chip icons, to bitcoin and cryptos limit up.

To remind readers of this coming phase shift, we most recently warned in June that “at some point Fed will concede it has no control over supply. That’s when we will start getting leaks of raising the inflation target“…

At some point Fed will concede it has no control over supply. That’s when we will start getting leaks of raising the inflation target

— zerohedge (@zerohedge) June 21, 2022

Well, it turns out that we were right, and not just about the coming mass layoffs, but also about the inflation target leaks. But first, lets back up a bit.

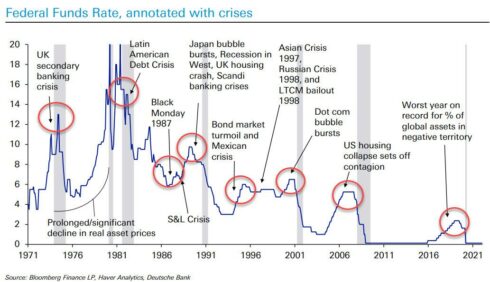

A little over one year after nobody expected the Fed would be hiking rates like a drunken sailor until some time in late 2023 or 2024, it has now become fashionable to not only predict that the Fed will keep hiking rates at every FOMC meeting and at the fastest pace since the near-hyperinflation of the 1980s, but that the central bank will somehow manage to avoid a hard landing (i.e., the hiking cycle won’t end in a recession or depression), even though every single Fed tightening cycle since 1913 has ended in disaster.

An example of this was the statement by former Fed vice chair (and PIMCO’s “twice-revolving door”) Rich Clarida, who told CNBC that “failure is not an option for Jay Powell,” adding that “I think they’re going to 4% hell or high water. Until inflation comes down a lot, the Fed is really a single mandate central bank.”

“Failure is not an option for Jay Powell,” says Former Fed Vice Chair Richard Clarida. “I think they’re going to 4% hell or high water. Until #inflation comes down a lot, the Fed is really a single mandate central bank.” pic.twitter.com/4hfLCVWZDP

— Squawk Box (@SquawkCNBC) September 9, 2022

Of course, if one could hike rates in a vacuum that could work – after all, Clarida himself, who admits he got this year’s soaring inflation dead wrong when he was still a daytrading god and part oft he Fed in 2021, said that the Fed may as well have just one mandate, namely to tame inflation. But what so few seem to recall is that the Fed is “hiking to spark a recession“, or as CNBC’s Steve Liesman put it, there is no such thing as “immaculate rate hikes” meaning that rate hikes have dire tradeoffs in other sectors of the economy. In other words, if the Fed’s intention is to spark a recession, it will spark a recession… leading to millions of Americans losing their jobs, something which even Elizabeth Warren appears to have grasped.

SENATOR WARREN SAYS SHE IS VERY WORRIED THAT FED IS GOING TO TIP ECONOMY INTO RECESSION

Looks like someone didn’t read Chairman Doom’s speech https://t.co/wQALP1aA3Y

— zerohedge (@zerohedge) August 28, 2022

Yet due to the recency bias of Biden’s trillions in stimmies, and a world where workers – whether working form home or the office – have virtually all the leverage, few today can conceive of a world where inflation is zero or negative and is instead replaced with millions in unemployed workers, an outcome which one could (or rather should) say is even worse for the ruling democrats than roaring inflation. At least, with runaway prices, most people have a job and their wages are rising (at least nominally, if not in real terms).

However, the higher rates rise, the closer we get to that inevitable moment when the BLS – unable to kick the can any longer – admits what has been obvious to so many for months: the US is facing a labor crisis of epic proportions with millions and millions of mass layoffs. And for those to whom it is not yet obvious, we urge to read a WSJ op-ed published by none other than Jason Furman, who is not some crackpot republican but Obama’s own top Economic Adviser from 2013-2017 and currently economic policy professor at Harvard.

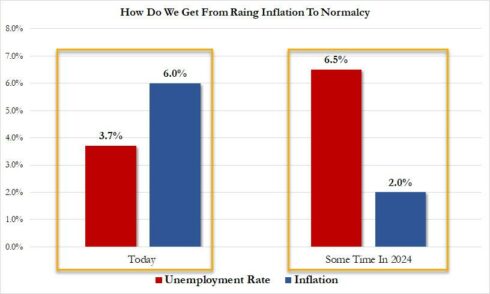

In “Inflation and the Scariest Economics Paper of 2022“, Furman summarizes a paper written by Johns Hopkins macroeconomist Larry Ball with co-authors Daniel Leigh and Prachi Mishra of the International Monetary Fund released by the Brookings Papers on Economic Activity, whose conclusion is as follows: “To bring price increases down to 2%, we may need to tolerate unemployment of 6.5% for two years.”

In other words, just as we said, inflation – much of which is supply-driven, which the Fed can do nothing about – will force the Fed to crush the economy by keeping rates for much longer, the result of which will be many millions in unemployed workers, or as Furman puts it, the paper “shows why the Federal Reserve will likely need to maintain its war on inflation, even if unemployment continues to rise.”

What is more remarkable about Furman’s read of the economist paper is that in addition to its primary theme (the lack of labor slack, or labor tightness, is responsible for some 3.4% of underlying inflation in July 2022), the paper admits precisely what we have been saying all along – that the Fed can’t control supply-side variables:

The paper also argues, convincingly in my view, for a different measure of underlying inflation. Fluctuations in energy and food prices are generally due to factors outside the control of macroeconomic policy makers. Geopolitics and weather have elevated the inflation rate in recent years. Plunging gasoline prices are temporarily lowering the inflation rate now. That’s why economists since the 1970s have focused on “core” inflation, which excludes food and energy.

But food and energy aren’t the only things people buy that are subject to supply-side volatility. Prices of new and used cars, for example, have gyrated over the past two years for reasons that are mostly unrelated to the strength of the overall economy. Both regular and core inflation are based on taking averages of price increases and can be distorted by large changes in outlier categories. The median inflation rate calculated by the Federal Reserve Bank of Cleveland drops outliers to remove these distortions.

According to Furman, median inflation – which is a statistically better measure of the underlying inflation that policy makers can actually control – is well above the Fed’s preferred headline inflation print (which fell to zero in July on a sequential basis and has stabilize) and shows no sign of moderating and has run at a 6.6% annual rate in the last three months.

But the “scariest” part of the new paper, Furman reveals, is when the authors use their model to forecast the unemployment rate that would be needed to bring inflation down to the Fed’s 2% target. He explains why this is so scary:

The authors present a range of scenarios, so I ran their model using my own assumptions… Under these assumptions, which are more optimistic than the authors’ midpoint scenario, if the unemployment rate follows the Federal Open Market Committee’s median economic projection from June that the unemployment will rise to only 4.1%, then the inflation rate will still be about 4% at the end of 2025. To get the inflation rate to the Fed’s target of 2% by then would require an average unemployment rate of about 6.5% in 2023 and 2024.

Under these scenarios if the unemployment rate rises to 4.1% then inflation will stay above 3%. If it rises to 7.5% then inflation will slightly undershot the Fed’s target.

The unemployment rate needed to hit the Fed’s target in this scenario is 6.4%. pic.twitter.com/ysUDUU6yaG

— Jason Furman (@jasonfurman) September 8, 2022

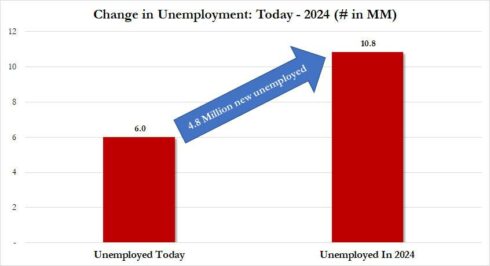

Where is unemployment now: it’s 3.7% (6.014 million unemployed workers vs 164.746 million civilian labor force). This matters, because according to one of the most erudite economist Democrats, by the end of the Biden admin in 2024, the unemployment will have to soar to 6.5% for inflation to plunge to the Fed’s historical target of 2.0%.

What does this mean in absolute numbers? Assuming a modest increase in the US labor force, a 6.5% unemployment rate in 2024 would translate into no less than 10.8 million unemployed workers, an 80% increase from the 6 million today!

Still think that politicians – and especially Democrats – will sit quietly and blindly ignore how high the Fed is hiking rates if it means that to normalize inflation back to 2% it means nearly doubling the number of unemployed Americans (and a crushing recession to boot). Spoiler alert: no, they won’t, and this may be one of the very rare occasions when Elizabeth Warren is actually right to worry about what the coming mass layoff wave means for Democrats… and the 2024 presidential election.

So what should the Fed do? Well, according to Furman, the Fed has four options:

- First, place more emphasis on the ratio of job openings to unemployment and median inflation as it assesses the tightness of labor markets and the underlying rate of inflation.

- Second, the new paper shows how much easier it will be to tackle inflation if expectations remain under control. The Fed should follow up on Chairman Jerome Powell’s tough talk at Jackson Hole with meaningful action such as a 75-basis-point increase at the next meeting.

- Third, be prepared to accept the unemployment rate rising above 5% if inflation is still out of control.

While we doubt #3 is actionable, what is more remarkable is Furman’s final proposal: it’s the one that, like the Dude’s proverbial rug, ties the room together and sets the stage for what is coming:

Finally, stabilizing at a 3% inflation rate is probably healthier for the economy than stabilizing at 2%—so while fighting inflation should be the central bank’s only focus today, at some point the Fed should reassess the meaning of victory in that struggle.

And just in case his WSJ proves too complicated for some mainstream experts and economists, here it is in truncated, twitter format:

(iii) Seriously consider raising the inflation target to something like 3 percent

This one is tricky. On a blank slate a 3% target would be better than a 2% target. But shifting to that could deanchor expectations.

— Jason Furman (@jasonfurman) September 8, 2022

And there you have it: remember what we said on June 21: “At some point Fed will concede it has no control over supply. That’s when we will start getting leaks of raising the inflation target.” Well… there it is.

And while mainstream economists and the market may require quite a few months to grasp what is coming, it is the only way out of a crisis of commodities – as Zoltan has repeatedly and correctly put it – and which central banks have no control over, and thus will have to move not only the goalposts but the entire football field to avoid a social revolt or something even scarier.

While we wait, we can’t help but snicker at what the 79-year-old figurehead in the White House tweeted today…

My first two years in office spurred the strongest economic recovery in recent history. Today, I’m releasing my Economic Blueprint, a look at how our wins are rebuilding an economy that works for working families.https://t.co/eSlr3ymdo8

It’s long. So here are the big things:

— President Biden (@POTUS) September 9, 2022

… because what Biden calls “the strongest economic recovery in recent history” is – even according to Democrats – about to be the biggest economic disaster in modern history.

Almost 400 million people have to deal with this Bullshit. The US is already falling apart

no problem: the .ua needs to feed cannons…