On March 10th, Kuwait and Iraq, as well as the UAE joined Saudi Arabia in reducing oil prices. Iraq cut the official selling price for its Basrah Light crude for buyers in Asia by $5 a barrel for April shipments.

That’s less than the $6 reduction for Aramco’s comparable Arab Medium grade. Kuwait reduced its selling price to Asian customers by the same as the Saudis.

The UAE, the only major producer that still sets prices retroactively, lowered the cost of its four grades for February sales by $1.63 a barrel from January.

“Any price war to acquire the largest market share does not serve the interests of the producing countries,” Iraqi Oil Ministry spokesman Asim Jihad said. His country is trying to bridge oil producers’ viewpoints to reach a deal to stabilize and rebalance markets, he said in a statement.

Iraq’s state oil-marketing company, SOMO, plans to increase exports in April, according to an unnamed person, cited by Bloomberg.

Kuwait set its April Export Crude OSP for Asian customers at a $4.65 a barrel discount to the regional benchmark, according to a price list seen by Bloomberg. That’s 60 cents lower than Aramco’s Arab Medium and $1.45 below than Iraq’s Basrah Light to the region. Kuwait’s exports to Northwest Europe were set at a record-low of a $12.60 discount.

Meanwhile, Riyadh is continuing on its “warpath” and is about to flood Europe with crude oil at a price of about $25 per barrel. The Saudi shipments, coupled with unprecedented discounts, are turning the European oil market into a major price battlefield.

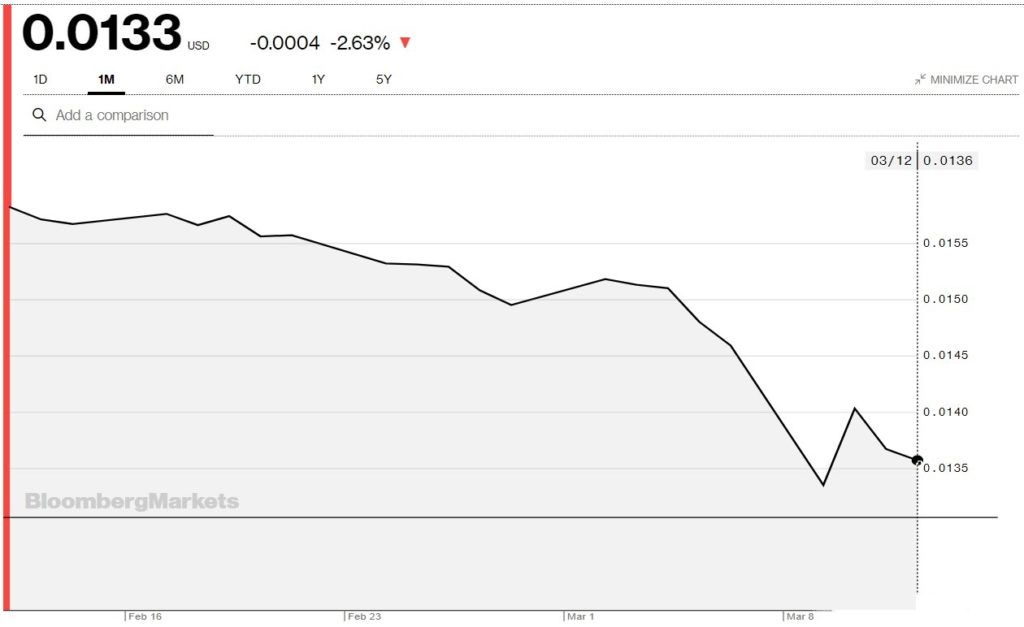

Diplomatic and OPEC sources quoted by mainstream media directly say that the ongoing Saudi-led effort to crush the oil market is a pre-planned ‘agressive campaign’ against Russia. One of the main targets is the Russian ability to sale oil to Europe. The fall of oil prices allready caused a major fall of the Russian ruble and impacted negatively the Russian economy.

European refiners including Royal Dutch Shell Plc, BP Plc, Total SA, OMV AG, Repsol SA and Cepsa SA have all received crude allocations from state-owned Saudi Aramco significantly above their normal levels, according to sources cited by Bloomberg.

The increase in volumes, known in the industry as nominations, was confirmed by Aramco to the European oil companies on Wednesday, the same people said, asking not to be named discussing private information. One of Europe’s major refiners got double its normal allocation, an unnamed source said.

Aramco cut its official selling prices by the biggest amount in more than three decades. The company made its biggest cuts for buyers in northwest Europe. An $8 a barrel reduction in most grades amounts to a direct challenge to Russia, which sells a large chunk of its flagship Urals crude in the same region.

Aramco will sell Arab Light at an unprecedented $10.25 a barrel discount to Brent in Europe.

Discounts for Russian crude immediately ballooned. Vitol Group and Trafigura Group Ltd. failed to find buyers on March 9th when they offered to sell Urals crude at the deepest discounts to a regional benchmark in almost two months.

Currently, the two countries who are suffering most from the oil war are Russia and Iran, both are also under heavy sanctions by the US. Iran’s oil sector is especially crippled owing to Washington’s “maximum pressure” campaign.

In Iraq, which as above mentioned is a major oil producer, a camp housing US-led coalition troops was hit by more than a dozen Katyusha rockets. The Taji base was hit and two US marines, as well as a British soldier were killed in the attack.

https://twitter.com/OIRSpox/status/1237823573672239110

“Three Coalition personnel were killed during a rocket attack on Camp Taji, Iraq, March 11. The names of the personnel are withheld pending next of kin notification, in accordance with national policies,” the statement said.

“Approximately 12 additional personnel were wounded during the attack. The attack is under investigation by the Coalition and Iraqi Security Forces. Camp Taji is an Iraqi base that hosts Coalition personnel for training and advising missions,” it added.

A spokesperson for the UK Ministry of Defense said, “We can confirm we are aware of an incident involving UK service personnel at Camp Taji, Iraq. An investigation is underway, it would be inappropriate to comment further at this time.”

Iraq is a hot point in tensions between the US and Iran.

Furthermore, on March 11th, the US House of Representatives approved War Powers resolution, which would require US President Donald Trump receive Congressional approvement for any attacks launched against Iran. He is, however, likely to veto it.

Regardless, this means that if, for example, Yemen’s Houthis strike Aramco’s infrastructure again, and both Riyadh and Washington blame Iran, Trump will have less options in the military sphere and face much more political pressure if he opts such a move. So, one could say that the Washington political establishment is limiting the freedom of actions of the Trump administration against Iran, but, at the same time, keeps the window of opportunities for anti-Russian actions open.

Taking into account that recentl US threatened Russia with more sanctions (this time over the situation in Idlib) and the US mainstream media is in the state of constant anti-Russian hysteria, US ‘experts and analysis’ will easily find the ‘Russian trace’ in any escalation in the Middle East or any other place around the world. They already found that the Kremlin should be blamed for the ongoing oil prices collapse, despite Russia being one of the most affected parties. This happens amid the ongoing consitutional reform in Russia itself. Pro-Western forces inside Russia and the neo-liberal part of the Russian elites are actively trying to use this reform to destabilize the situation in the country and turn its course in what they call the ‘right direction’ (the surrender of the national interests to the global capital). These forces as well as their foreign backers are openly interested in the escalation of tensions between the United States and Russia.

MORE ON THE TOPIC:

Wasnt Russia unaffected and they could go on like this for years? Russia sadly overrated their ability to influence OPEC and is getting a lession now i guess.

Both Russia and KSA are working next to OPEC. OPEC tried to convince Russia not to increase the oil production and KSA has its own agenda also bypassing OPEC with doing the same. Someone is pressuring someone and it’s about to see the consequences of those pressures.

On the contary low iq gimp,russia told opec to stfu,every man for himself,fair is fair low iq bot!

Eat shit retard arab camel dick

The will probably backfire on the slimy Sauds.

Maybe. But it sure is going to hurt Putz Putin and his RF a lot as well as put a few more nails into the economies of Islamist Iran and want-to-be Socialist Venezuela. Sounds fine to me.

Strange considering to date you have yet to prove anything factual nazi/socialist troll!

You have zero understanding of what is actually going on and your statements add no value to the conversation.

It has to, by the math. Saudi Arabia’s budget balances at something slightly above $80 a barrel. So, Saudi Arabia has been exporting oil for months with revenues already unable to meet budget. Russia, on the other hand has diversified enough that her budget balances right about $46/Brent. She has exported for ten weeks at more than ten dollars average above that. Which means that the average price won’t even begin to affect Russia’s budget for six weeks or more while Saudi Arabia’s budget, already in the red, is now in dire sucking sound straits. The Saudi’s are throwing a tantrum to try and bring Russia back to the table but the Russians prepared for this for years. They’re ready. Russia is clearly tired of American shale mooching off the tailwinds of production quota’s for breakeven price marks while sharing none of the responsibility for price support. Russia said they are prepared for $25 oil, for years. I believe them. They didn’t fill their piggy bank for nothing.

I’m trying to figure out what this article is all about.

I certainly don’t think the author knows what he is about.

1. “Currently, the two countries who are suffering most from the oil war are Russia…”

How do we come to this conclusion?

2. No mention of U.S. shale, why not?

3. No mention of KSA, 85$/b oil price, why not?

4. “Regardless, this means that

if, for example,Yemen’s Houthis strikeAramco’s infrastructure again, and both Riyadh and Washington blame

Iran,

“If, for example” what kind of lame comment is this?

Namby-pamby commentary at its best

Whatever. Putz Putin and his RF are going into even deeper doo doo as this price war kills the Ruble, slashes Russian export revenues, puts a serious crimp in the Russian budget and thus the Putz’s Greater Russia Follies, increases inflation, increases interest rates, undermines the economy and pushes the RF towards a deep recession if not depression. And brings the Putz and his RF closet to keeping the thankfully dead Russian Soviet Empire company in the dustbin of history. While it helps the US’s economy with lower gasoline prices. Not a bad thing.

You are displaying vast ignorance. Russia isn’t losing money yet. They have already averaged well over budget sales for months; newsflash: this isn’t the first day of the year. The Russian public will hardly notice, it’s the pro-western investor class in Russia who is freaking out and spreading hysteria. But outside of some districts of St. Petersburg and Moscow very few people will care that Russia’s massive trade surplus just trended back to…even. Or that later this year Russia will have to dip into reserves to balance the budget. It’s American shale producers that Russia is after, and the New York and Austin bankers who are leveraged to the hilt for hundreds of billions of dollars that they can’t get back. Dustbin of history, hah! Critics of Russia have been saying that for forever yet she never goes away. Saudi Arabia on the other hand is throwing a temper tantrum because her future as a kingdom is very much in jeopardy. The Saudi’s don’t make anything, they import it all, including labor, and pay for it using oil revenue. Hmnnnn. If they can’t placate their population with imported trinkets how will they survive? Your dustbin of history may get a new entrant but it won’t be Vladimir Putin and it won’t be the Russian Federation. I’ll be here later this year or early next to laugh at you.

LOL…last I checked, there are already at least two Russias in the dustbin of history. The Czarist one and the Soviet one. But look on the bright side, you’ll have familiar company down there, Igor.

Dustbin of history? Umn, Russia continues to exist. Current Russian military units maintain the battle flags and traditions of the Soviet era, and Russia is the successor state to the USSR, and in 2006 paid off the last of the Soviet Union’s debt. They didn’t go anywhere and were not conquered by anyone; they changed their political and governance structure. The national anthem had the words changed but kept the tune. The flag changed but there remains great respect for the Soviet era flag. The Red Star is still on Naval vessels and aircraft and Lenin still resides in Red Square. I wouldn’t be surprised that as capitalism continues to show itself as a big failure at moving civilization forward that we don’t soon see the Russian Socialist Federation, with a sickle and hammar imposed in the corner of the Russian triple color flag.

As well with the completion of the Siberian pipe line Russia will be able to supply most, if not all, of Chinas oil and gas so no more US or Saudi oil and gas going there.

Economics isn’t one of your strengths is it? Remember there are 2 sides to a balance sheet so it’s not the size of the economy that counts but the difference between assets and liabilities. A positive number means you are worth more than you owe but a negative number means you owe more than you are worth.

The USA is in vastly negative territory.The Russian economy shows a healthy balance sheet with positive asset to liability ratio while the US shows a country in debt to the tune of nearly 200% GDP just in state, local and federal government debt as well as huge corporate and personal indebtedness. Yes the posted US government debt is 106% of GDP however that number doesn’t account for state and local governments

US debt is what the Saudi’s and Russians are targeting with this play with US banks being the real target. Shale oil companies are just the means to get at the US banks … the trigger so to speak. The Fed used quantitative easing (printing money) to get over the financial crisis but never actually dealt with the structural problems that led to the crisis. It’s the petro dollar …. and mainly the Saudi promise to sell oil in USD …. that allows the Fed to print money without causing inflation.

Well it looks like the Saudi’s are becoming less co-operative with the USA and is in fact cooperating with Russia now in this play against the USA. The big question is whether this Saudi attack is strictly against shale oil or if this is an attack to take down the USD hegemony.

I would really be a bitch is the USA had to live within their means and are limited to sub $100b defence budgets like the rest of the world no?

That’s spot on to what is actually happening and one of the best comments I’ve read on the subject. It’s funny that all kinds of people are freaking out, but President Putin and company are calm. The Kremlin said that there have been strategy meetings about this for years, and Russian oil producers have wanted to produce at capacity for some time now. It’s not surprising though to see pro-western propagandists completely misread this situation, it’s just so laughable that they openly fail to perform basic statistical calculations that a first year political science major or economics major could do in five minutes to see who really is in trouble by all this.

LOL…and that is why the US Dollar is fretting stronger while the near worthless Ruble is falling? Why our interest and inflation rates are near zero and falling while Russia’s are way higher and now increasing. Maybe Putz Putin your brilliant hero should have taken those courses before he signed those massive contracts with China to sell them natural gas at a price tied to that of oil. And all those Putz like geniuses spent years working out a way to lose even more money by going into full production in a world with a glut of oil reserves and falling demand. Maybe there is something in the Vodka rations there that F’s their brains. Well, at least they aren’t as stupid as your Islamist Iranian heroes who are binging on wood alcohol to cure the Coronavirus.

But they didn’t. Anyone paying attention to Russia would have seen them hit benchmark after benchmark over the past six years at diversifying their economy, reducing budgetary dependence on oil and gas revenue and working at import substitutions. Russia is just not vulnerable to economic pressure points the way most other countries are, which is why nutcases pour on more sanctions and are confused about why Russia continues to grow. Answer: most of Russia’s economy is domestic and internal. They are consuming their own production with little dependence on exports or imports. Oil and Gas revenues were basically used to fund their military buildup and to save for a rainy day. Done, and done. Hence, now the confrontation. The U.S. dollar, per your point, is overvalued because it is seen as a safe haven due to it’s longstanding petrodollar and reserve currency status. Currency values have dipped and risen over the past few years but except for several situations everything has remained stable including the rouble. This dip is slight, and works to ween Russia farther off hydrocarbons as it makes Russian vehicles, metals, and machinery less expensive on the world market. This has all been planned for, dunce.

Also, with Russia looking more to China this will help Chinas economy and Russia’s. The Siberian gas and oil pipe lines are almost complete so it win all-round for both countries and their friends. If you remember, a few years ago when US was threatening Russia President Putin said, “I will arm your enemies”. We live in interesting times.

comes from dropping out of school too early

Sorry you dropped out of school. Mike may not have but he sure avoided studying finance and economics.

Just the proud product of a US public education.

The US holds about a third of the entire world’s net wealth. That’s assets after subtracting out all public and private debt. The government has a high debt but about two-thirds if it is owed to itself and NOT foreigners. Debt owed to yourself is a wash. Oh, if you were correct, the US wouldn’t have near zero interest and inflation rates that are still falling. And Russia wouldn’t have much higher interest and inflation rates that are now increasing. The US Dollar wouldn’t be getting stronger and the Ruble wouldn’t be near worthless and falling yet again. Try to keep up. I would suggest you take Econ and Finance 101 but you would have to pass basic arithmetic first which seems congenitally beyond you.

It’s called a bubble. Most U.S. growth since 2008 has been completely debt fueled. The U.S. holds assets on the books that show up as wealth but are not really worth the stated ledger value. Anyone paying attention and heeding the lessons of 2008 when strippers were leveraged to the hilt while owning a house and two condos would understand the nature of the ongoing debt bubbles in the United States.

Debt is debt it doesn’t matter who you owe to …. the US government covers it’s debt by issuing bonds. Do you really believe that wealthy Americans would continue to buy US bonds and T-bills if your country defaults on them? that is in essence what you are claiming.

if what you are saying is true then why aren’t Americans voluntarily paying more taxes … that’s paying down the debt but you don’t see wealthy Americans voting for raising taxes or simply throwing in a couple of $million more to help out do you?

And what about the stock market …. if wealthy Americans were so altruistic about the state of the US economy why aren’t they keeping their money in the market? That would help keep the price of stocks from falling and improve US corporations balance sheets but that will never happen in a million years … It’s like rats escaping a sinking ship today.

Did wealthy Americans volunteer to bail out the banks in 2008? How about GM or Ford?

“Oh, if you were correct, the US wouldn’t have near zero interest and inflation rates that are still falling. And Russia wouldn’t have much higher interest and inflation rates that are now increasing. The US Dollar wouldn’t be getting stronger and the Ruble wouldn’t be near worthless and falling yet again.”

You really are a proud product of the US public education system aren’t you.

Near zero interest rates are the problem not the solution. They are being kept artificially low, the only reason there is demand for US bonds is because of the petrodollar …. because of an agreement between the Saudi’s and the USA made back in the 1970’s most of the world buys oil in USD. With returns so low on US bonds no one would buy them if they could buy oil with any other denomination. If they world no longer needs USD to buy oil interest rates in the USA would skyrocket to reflect the fact that the USA doesn’t have the assets to cover it’s debts.

this is also why you’ve had a seven year bull market and a stock bubble about to pop …. if bonds paid decent interest rates no one would buy stocks however there are no safe havens left besides bitcoin …. and in todays economy bitcoin seem safe.

So do you understand now the risk of having the Saudi’s make a play agains Shale oil? They are already pissed at the USA for keeping the price of oil low due to the ‘shale oil boom’ and they are hurting economically. All it would take is for the Saudi’s to decide to sell oil in any other currency and the USA is sunk …. hyperinflation and bank defaults galore. And you can bet both Putin and XI are whispering tales of security and riches in MBS’s ear right now if he agrees to join them.

Excellent!! I said the same yesterday in another post but I didn’t use as many words. https://media0.giphy.com/media/OF4PIvoHuO2ze/giphy.gif

Debt doesn’t matter in the American system, nothing does, it’s all a monopoly game as long as everyone keeps playing its as real as death but when people stop this worship then poof, bye , bye !

“Well it looks like the Saudi’s are becoming less co-operative with the USA and is in fact cooperating with Russia now in this play against the USA. The big question is whether this Saudi attack is strictly against shale oil or if this is an attack to take down the USD hegemony.”

In regards to this section of your reply, which I agree with wholeheartedly, I would like to share a link that may provide some background to the current events:

https://www.voltairenet.org/article209439.html

With the shale going out of business, how else are you going to pay for your meth and crack habit there trailer park.

oh they have the jar at haifa.. you just dig in since its constantly filled by the american tax payers..

Nahhhhhhhh…actually the relatively small amount of US aid to Israel compared to its total budget is all for military equipment made in the US creating good paying jobs here. Next silly comment from you…

Good paying jobs? Oh I see, that’s why most people infected by the coronavirus cannot afford sick leave, or even a test, since they don’t have the money from those good paying jobs for it.

I have zero interest in the shale oil industry. And I enjoy my top floor condo view overlooking the Bay Area just fine. Too bad a dreg like you could never afford to live here except on the streets with the other dregs.

This Yakub321 clown lives in San FagsCrisco. If poop on the street were as valuable as oil, you all could afford to give every homeless junkie on your streets one of your $1,000,000 2 bedroom ranch homes.

https://wmmr.com/wp-content/uploads/sites/15/2019/04/San-Fran-poop-map-768×614.png

And he has a front row seat to America’s decline, if he chose to look. I sat for one day in San Francisco in 2018 and watched two container ships during the course of an afternoon. One came in, attended by tugboats, low in the water, clearly heavily loaded. Another went out, about an hour later, high in the water, clearly mostly empty. I talked to an old retired janitor about it at the park I was at and he told me he’s been seeing that for years. The U.S. is bleeding cash, exporting very little whilst importing nearly all products that give a developed economy value. It’s right under Jake’s nose and shows up year after year in just miserable trade statistics. But, he thinks Russia is the one in trouble. Jokes on you Jake.

Another aspect of America’s decline can be seen in Jakub321’s poast above; he gloats from an ivory tower about living on a grossly overinflated parcel of real-estate, thumbing his nose at the hoi-polloi in flyover country.

The internal divide between the ‘elite’ coastal areas and ‘flyover’ territory is getting wider by the day. Coastal liberals live inside a bubble of their own self-importance, and they take the national fellowship of flyovers and hicks for granted.

A time is coming when flyover territory is no longer gonna co-operate with the ivory tower dwellers on both coasts, and their untenable position will become painfully obvious when the store shelves are empty and the tap quits running.

True.

Germany with a pop if 83million exports more than the U.S.

Trade deficit is around $640billion a year.

Wow, lower gasoline prices. Now that’s a winner

Lower gasoline prices.

Yup, all the murikans that live in their cars because they have no other place now have cheap gasoline.

All the GIG economy entrepreneuers now have cheap gasoline.

Man you are one braindead, at birth, khazar.

LOL…anyone who downplays the cost of transportation like you clearly is an ignorant fool.

It’s hard to face the facts, isn’t it, Khazar.

you’re behind the curve dummy.

why not spend your time comtemplating your khazarian dna, dips**t instead of babbling BS.

The Financial Times, a UK-USA money mouthpiece, is explaining it for you. In an article dated March 12 and titled “Can Russia use Saudi price war to strike a fatal blow on U.S. shale? : armed with $570 billion in reserves Moscow appears ready for a long fight.”

They lay it all out for you, in logic that even you can understand. Russia has planned for this, is relaxed about it while other people hysterically panic, and can weather $27 oil for years.

The KSA $85/bbl oil is a budget price, i.e. that’s what SA needs to balance its budget. Pie in the sky, of course.

A kind message to the Turkish: we are waiting for you girls…

https://uploads.disquscdn.com/images/0945c2645633c7c1abcde6b23454e7960a96c498148ca437675bebdb6dad154c.jpg

What does this have to do with Putz Putin’s RF accelerating down the oil price slide to join the Russian Soviet Empire in the dustbin of history?

Wooooo? You don’t like Putin?? Ahahaha…

Yes truely my post was for other subject.

But your “dustbin” opinion does not matter

So?

So you’re a fake jew in stay in your dustbin jacky… Nobody needs you here. Aaaaand we don’t like Zionist trolls. You Mossad little piece of shh…

Nah. Russia has spent the last six years diversifying her economy. Russia makes 70% of what she consumes and is now among the world’s leading exporters of grain, refined metals, power plants, weapons, and has even made some limited progress in exporting vehicles. Russia has already averaged months of oil prices well above $50 a barrel which means they can sink the oil price into the teens for several months before having to take money from reserves, of which they have hundreds of billions of dollars. They’ll be fine.

Almost half Russia’s budget is from oil and gas. Over two-thirds of its export revenues come from oil and gas. People eat and use way more than wheat. Russia is only 7th in terms of agricultural production, way way behind China and the US. Try to get the basics correct.

That was true in 2014. Russia has reduced it’s tax dependence on oil and gas to down around a third. Try to get this basic right: Russia’s agricultural sector exploded in 2014-2018 because of sanctions and counter-sanctions. They have been practicing import substitution for years and can basically feed themselves, excepting some crops which don’t grow well in Russia. Russia’s grain exports more than pay for all her food imports, and that’s before barter exchanges like the recent 10 Su-30’s for large quantities of Indonesian agri-produce, especially palm oil. The U.S. production figure loses it’s value, something you’d be hard pressed to know unless you lived in the Midwest. Most of the U.S. grain production is for animal feed because livestock protein represents the core center of Americans diet.

The western stock markets are in bear territory and lost over 14 trillion in value, while the Chinese markets are doing much better.

The highly leveraged US oil market will be part of the dustbin of history becoming a net importer.

Listen up, the western economies are supported by reckless money printing, while Russia has little debt and a lot of gold.

He doesn’t care about factual realities like that. He’s here to spew out Russia hatred, mindlessly. Russian reserves don’t matter, who breaks even at what price points, how oil contracts are structured, who is leveraged up, he neither knows or cares and it shows. I wish I could be in the rooms some day soon when the world flips and the U.S. collapses, and NATO gets flushed out the next day and Islamic extremists riot in Paris and London and yet Russia carries on under the flag of law and order. Just to see the look on the faces of people like 321 will be priceless.

That’s a room you will never see. Nor will your great grand kids and beyond. Putz Putin’s RF requires over $40 a barrel to keep its government afloat. It is $10 a barrel short of that already. And increase production will lower the price even more. Yep, contracts are important. And genius Putin signed massive contracts with China to sell them natural gas tied to the price oil. Oh, when he did that, the price was at the break even point. So each sale now is a big loss. That is why China is smiling.

Oh, I bet I see it all right. You fail to understand that Russia is still above budgetary level this year. They sold oil for over $56 a barrel already for ten weeks and have $50+ a barrel contracts into June. They can drive the price point down powerfully for months and still break even. Or do you have slow learner problems with basic statistical computations in addition to a warped moral compass?

Hey, dodo, if that was so your interest rates wouldn’t be moving up to almost ten times our declining rates which are near zero. And your government bond rating wouldn’t be just above junk. Time you learned arithmetic so you could take an elementary class in finance and economics.

Bond ratings companies are American intelligence assets. Russia’s bonds are less than desirable in the international market because they’re sanctioned. Not that it matters because Russia has oligarch money to lean on for borrowing needs as more than half of it has returned home for safety because of potential sanctions. Not that that really matters at the moment because Russia’s currency and metals reserves total some U.S. $565 billion on government debts totaling $220 billion. U.S. interest rates are low because there are vast segments of the American population who have next to no disposable income. It’s why the only significant retail sector growth is in dollar stores. To keep the money flowing through the economy the Federal Reserve did quantitative easing (printing money) and now simply prints cash and deposits it in banks overnight so they have enough cash to loan one another money. But, there’s a reason you don’t do these things and the primary reason is that the value of money becomes distorted over time and in a recession, especially a deep one, the government has limited tools at it’s disposal to bring the economy back. Wait, wait, wait for it. Tick, tock…

Hey, dodo, the US has more than 4 times the gold of Russia. And not only is the Russian markets tanking, so is the Ruble. Plus their interest rates and inflation will be going up even more. Putz Putin’s RF is in deep doo doo but just wait till November when the Dems win and serve vengeance on them real cold.

Hey do do, there is no gold in the Fort Knox vaults, US is a bankrupt country, with their artificial wealth disappearing . Economic warfare waged by China and Russia against the Empire and its poodles is costing the western economies a few trillion dollars a day..

The empire has nothing to serve but useless sanctions.

In a war there are casualties, western economic casualties are heavy and continuing.

LOL…that’s why the USD is the preferred reserve currency? Why US interest and inflation rates are near zero? You could use an basic education in finance, Igor.

Hey dodo, no one knows that for sure. Fort Knox hasn’t been audited since the early 1970’s. But, even if true why would it matter? Russia’s precious metal and hard currency reserves would allow her to pay off her debts with $300 billion dollars worth of reserves left over. The U.S. bullion, even if all made liquid, would barely put a dent in U.S. debt.

LOL…seems you’re just another tinfoil hat looney toon. Damn, that really gives you credence. And I’m sure you have personally seen and weigh all the Russian gold reserves and counted all their foreign currency reserves. Oh, if you missed it, when you print the preferred foreign reserve currency that most all the world wants, you don’t have to hold much in the bank. Now how much in the way of your near worthless Rubles do other countries hold, did you say?

precisely…the USA has zero gold

experts all observe that the purported gold claimed by the USA has never been audited—the US govt refuses examination by experts of their so called Ft Know gold—either it does not meet international standards, or it does not exist!…..of course little Jackie has no academic training in any subject…certainly not economics

Maybe the bricks are made of gold plated tungsten neatly stacked for photos.

Just another pack of cruise missile and Drones vs Aramco…and end of the problem!

I wouldn’t be surprised if this is being discussed as we speak in the white house. I sure wouldn’t put it past them.

The real goal for opec + is the shale industry, once out of the way, we will shortly return to discussing production and prices.

Strange, I left comment stating that the end of the shale industry would be a boon for clean underground water resources, but it disappeared. First time that has happened.

And once the price goes up again, back will be the shale producers and down will go the price again so Russia is back in deep doo doo. Unless they can rejoin with OPEC on artificially holding THEIR production down to support oil prices. Oh, and that will expand the shale industry even more. Seems the control of global oil prices is no longer as easy as before. Either way, it’s not good for the future of the Russian economy unless they can diversify and increase their domestic sector.

Seems to me that both Russia and Iran could cope with a months blockage around the Straits of Hormuz.

Be interesting to see the level of technology (rocket mines, etc) that could be employed.

And Islamist Iran may not like having its nuke facilities and much more wiped out. But yes, the higher oil prices would help Russia and also the US shale producers. Oh, in no time the gain Russia makes will be more than wiped out by new draconian sanctions. Next silly suggestion from you…

So agreed, both the U.S. and Russia would be gainers.

ha ha! rossiya economy will be destroyked and shattered by US treasury! no more stinky rubble be crash to ZERO SOON!

Ha Ha, there is a new disease for perverts who cut off bits of their bodies, and I hope you get it.

Only Jewhadis cut off their knobs.

I didn’t know Muslims, boys AND little girls, are Jewhadis.

USA will defeat Rossiya drunkard just like they defeat Nazi Germany in 44-45 and kill 2 million nazi souljiers

sounds like jake-off123 has his entire braindead family online today. lmao

Ahahaha…LOL…

You’re wrong as usual.

you mean there is more of you idiots out there? Holy S**t Batman they’re like Covid.

their self humiliation continues to amuse

The US turned up at the last moment, after the Russians had destroyed your heroes, you Jewhadi cunt.

Yes daddy, we will think of it . You’d better go back to your armchair in front of your TV.

FoxNews? CNN? Do you know the fake jews story? Ask Jake, and Iron Zion , they are already aware… And terrified…

Tell them to take it out of their nuke and missile programs. And drink more wood alcohol.

Trump isnt getting pushed into anything, he is running the show. Trump is a showman and this is nothing more than a good cop, bad cop routine.

weak satire…or pure stupidity

and they should get it right away !!!!

oh, you poor trump!

You can’t win a war indirect or other when the other side holds all the best cards. You either fold or go for the kill, Putin choses ballet, not chess or poker. Czar for life it appears we will see much more of Putin the meek.

But look on the bright side. He may have a very short life as the RF economy collapses from his oil price war on top of his Greater Russia Follies adding in his new arms race with the US. Not to mention the gigantic contracts he signed with China to sell them natural gas tied to the price of oil.

Bernard Williams describes CIA fake news contained here as “the fetish of assertion”

the loser here is the USA..obviously

Nahhhhhhh…even this version of you, Ivan or Igor, is wrong. You Putz Putin the Poisoner Trolls should at least try to sound alike when you change sifts. You truly are entertaining. Makes it worth dropping by.

The small Gulf monarchies have hardly a chance to do anything else but “join” saudis in a price war. It’s not like they can raise the prices instead.

Nope, not Russia, but Saudi Arabia itself is suffering most together with Iran. SA is virtually bankrupt due its huge multi-year budget deficits, whereas no debt and has built up a significant stockpile of gold. So, Russia will weather the downturn in oil prices much better.

Anti-Russian actions are not the same as conflict: the latter term suggests a military conflict, something the OUTLAW, psychopath-run, blackmailing, sanctioning, belligerent, rogue empire-in-decline would not dare.

Financial Times article March 12 is the article SouthFront should have ran with. It explains what is actually happening.