The United States’ next move in the trade war with China will reportedly be a surprising one, and shows some good historical knowledge, as reported by Bloomberg.

Allegedly, the US may revive 100-year-old Chinese bonds, which actually pre-date the People’s Republic of China, from when it was just the Republic of China.

They are largely defaulted, and China has never recognized the debt, but that hasn’t stopped many from wanting to cash them in.

President Trump, U.S. Treasury Secretary Steven Mnuchin, and U.S. Commerce Secretary Wilbur Ross actually met with bondholders, who are hoping that the POTUS would actually push their case in front of China as a way to pressure it.

How that would work remains a mystery, since China may simply say that it won’t recognize a debt pre-dating the current country.

Regardless, Jonna Bianco, a Tennessee cattle rancher who leads a group representing pre-revolutionary China bondholders and who has met with the president said:

“With President Trump, it’s a whole new ballgame. He’s an ‘America First’ person. God bless him.”

These bonds, are a sort of old-style “soft-power” tool, used to increase US influence through “dollar diplomacy” – help the country industrialize and at the same time improve relations with it.

Regrettably, thought for the bondholders, China refers to the bonds as part of its “Hundred Years of Humiliation,” when it was forced to agree to “unfair” foreign control.

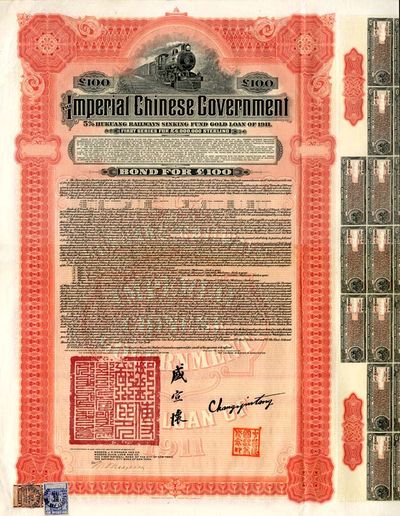

The Republic of China, after the Imperial dynasty was overthrown in 1911 needed funds, and it sold a series of gold-backed bonds to fund the country. These are the bonds specifically that Jonna Bianco and others are hoping to leverage in the trade war. She even co-founded the American Bondholders Foundation (ABF) in 2001 to represent holders of pre-communist debt.

“The People’s Republic of China dismisses its defaulted sovereign obligations as pre-1949 Republic of China debt, but doing so contradicts the PRC’s claim that it is sole successor to the ROC’s sovereign rights,” Bianco said in an emailed statement to Bloomberg.

Bianco, probably for naught, has spent years researching the topic and recruiting high-profile proponents to the ABF side. These include Bill Bennett, who was U.S. Secretary of Education under Ronald Reagan; Brian Kennedy, senior fellow at the Claremont Institute; and Michael Socarras, Bush’s nominee for Air Force general counsel.

China is probably quite worried that Donald Trump may be added to that list and it will probably be prompted to, once again, just say it won’t recognize the bonds.

According to Bianco, China is in selective default, after in 1987 it actually paid out bonds to British investors in 1987 as part of the Hong Kong handover deal, negotiated by politicians far superior than what the US has right now, such as former Prime Minister ‘Irony Lady’ Margaret Thatcher.

In Bianco’s understanding, China should be prohibited from selling new debt on international markets, if it doesn’t pay out its current debt. In her estimation, China owns $1 trillion on the debt, which is roughly equivalent to what China holds in US treasuries.

“What’s wrong with paying China with their own paper?” Bianco said.

Unnamed people, cited by Bloomberg, familiar with the Treasury Department say the China bonds have been studied, but ABF’s suggestions—including the possibility of selling the defaulted debt to the U.S. government to then exchange with China—aren’t legally viable. Spokespeople for Treasury and Commerce declined to comment.

“I think everyone who works for Trump at the Treasury Department thinks this is loony,” says Mitu Gulati, law professor at Duke University and a sovereign-debt restructuring expert. “But I can’t help but be tickled pink, because at a legal level these are perfectly valid debts. However, you’ve got to get a really clever lawyer to activate them.”

And lawyers have tried, in 1979 there was a class action suit brought by holders of Hukuang railway bonds that actually brought the People’s Republic of China to a US court.

The suit was thrown out on the basis that the 1976 Foreign Sovereign Immunities Act, which allows U.S. courts to hear cases against foreign governments for commercial claims, could not be retroactively applied to bonds issued at the turn of the century.

This all actually relies on US jurisdiction, since if China simply says it refuses to acknowledge it, there’s no way to force it to, similarly to how the US disregards most of the international law bodies.

This possible move, more than anything resembles an exercise in futility, but time will tell.

MORE ON THE TOPIC:

Did not the ” Republic of China “, move to Taiwan when Mao took the mainland.

Right.. So they must be the more appropriate debtor. Good thinking! :)

yes, you are right

You are wrong as the PRC claims ROC does not exist.

Well Taiwan were the traitors….. they also gave the Yanks all of their gold that has ever been repaid, so this will get nowhere… justmore US drivel.

Will this ancient debt be utilised the Yanks to freeze the maturity on the Trillion dollar bonds that China has invested in. Lawfare in the US courts could take a generation to resolve.

What the US fears the most is the dumping of their bonds by China.

It will not happen, because every nation will smirk and lose confidence overnight in the USA.

I knew I read something about it – https://www.rt.com/usa/467593-trump-china-antique-debt-bonds/ ……..look at comments as well.

PS If you like reading, please read a fictional book by James Patterson (well his name as usual takes preference) called “The Store”….

Chiang Kai Shek moved “The Republic of China”, his government to Taiwan in 1949. They were gold backed bonds so do you know more on “they also gave the Yanks all of their gold”.

Is it possible the bonds or some of them were paid off ?

Taiwan was not even part of China until 1945. Read your history. Taiwan was never part of Imperial China. It was an island populated by Malay speaking tribes that still exist. The Dutch colonised for a short time, bringing in Chinese settlers and laborers. A chinese pirate chased the Dutch and then it had a vague status for centuries. In 1895 it became Japanese. Until liberated by US in 1945. In 1948 Tjang Kai Shek lost the chinese civil war and evacuted almost a million of his followers and armies to Taiwan. In Taiwan the new government made the reforms it did not at the mainland, creating a prosperous, modern and now democratic society that is vehemently opposed to becoming part of PRC and that will fight with a large army to remain as they are now.

https://en.wikipedia.org/wiki/Taiwan_under_Qing_rule

Until 1945, that is modern history, that was we in Britain and the US decided the borders.

Cheerio.

Taiwan was annexed by the qing empire after a famous ming chinese pirate defeated the dutch and sent them all packing. That pirate is famous in china amd taiwan was part of imperial china for centuries. Then taiwan was later taken by japs for a shorter time.

Then the japanese lost ww2 and taiwan was given back to china.

Kmt were origonally mainlanders and after losing the chinese civil war, fled to taiwan. They were not native taiwanese but just mainlanders whi fled to taiwan and subjigared tge aborigines and forced them to speak mandarin and adopt chinese culture.

“Read your history. Taiwan was never part of Imperial China.”

Lol It was, from 1683 to 1895.

http://www.badassoftheweek.com/index.cgi?id=402341815414

Taiwan is not tied to old Chinese Monarchy, China became a Republic in 1912, these bonds were with the Quig Chinese Government representing the Manchu Quit Dynasty which began in 1644.

Sorry Rodney, but the bonds were with “The Republic of China”…. Re-read,

“The Republic of China, after the Imperial dynasty was overthrown in 1911, needed funds and it sold a series of gold backed bonds to fund the country”.

The word “imperial” is admittedly misleading. Lead latter by Chiang Kai Shek, from 1928 until his death in 1975. In 1949 he moved his government from mainland China to Taiwan.

You got it.

I just wanted to write, that if it is due, then Taiwan has to pay it.

more american BS

maggie thatcher forced the soviet union to honour old debts from the tsar-era by refusing the soviets to enter the international bond-market when it turned up and wanted to borrow against bonds. so apparently people started to take down the old bonds from the walls of their loos where they had been used for wallpapering the sanctuary – they didn’t get a whole lot on the pound but there was some satisfaction some 70 80 years after the fact!

What the thing to remember about Chinese finances, they never did Quantative Easing, so where does all the money come from? after all Chinese State run Companies are more indebted the US corporations.

I’m no expert but I am pretty sure it’s simply electronic transfer which replaced “new issue currency” being printed by one single State nominated bank, Fed., Bank of England, Bank of Japan ect. Coupled with fractional reserve banking there is no real need for Quantative Easing if the State is in direct control of the Monetary System and using its Central Bank as its tool.

This is what Trump wants for the Fed and Johnson wants for the Bank of England, but got no chance against the Rothschild’s who own all Main Stream Media.

The big advantage is that if all fiat currency collapses all debts become worthless, the Chinese State run Companies will be able to operate business as usual if they can get resources, the Japanese couldn’t in 1930 because they were an internal market, China is external market they have something others want and are dependant on, China will likely take advantage of this situation if Trump keeps pushing, but I think Trump is about to collapse like he did with North Korea.

sure and when all debt become worthless so will also the other side of the coin, the deposits, become worthless – it’s a haircut of some severity to come! so deposits in the banking system is not what you like to have and that is one reason why gold is at 1521/ounce today, up some 300$ since april.

China saved fiat currency in 2009 by supporting the IMF and as a reward the Renminbi was accepted into the Statutory Drawing Rights in 2015 along with other hard currencies even though the Chinese refused to unpeg from the USD, maybe China doesn’t want to be in that future any more.

If not there could be a great catastrophe and gold will be worth much more, but I think private companies engaging in barter will save humanity more so than gold.

To go back to a gold standard?.

Which Nation woul dare back their paper and computer edits with gold, what would happen if too many others wanted to exchange reserve paper and edits for real gold even if gold were $30,000 an ounce it would still be impossible

Trade is Goods $20 trillion plus $6 trillion Services traded yearly.

At the moment the Fed. Is holding $126 billion and China is holding $3 trillion.

The US gold holdings 2019 is 8,133•5 tonnes.

With 4,683 tonnes in Fort Knox valued at $210•8 billion.

China has only got 1,842•6 Tonnes of gold which is 2•4% of its reserves, so China wouldn’t want a return to a gold standard .

The remnants of Imperial China could be said to be Chinese Taipei. (as pointed out by others here)

This is an act of desperation from a idiot who now realises he bit off more than he can chew.

Seriously, if the US was “winning” this trade war, does anyone think they would be so desperate as to contemplate this pointless charade?

China has to sell the treasuries now.

Else they will maybe get troubles with yews in Washington.

This is pretty Dickensian. Have the chinese historical bonds been continually on a balance sheet in the US, or are they dug up now as an inconvenient historical fact. It is how the Rothschilds would operate.

China could of course pay it all by simply printing out the money required. Only that would lead to huge inflation of the chinese currency – and that is exactly what the US does not want! It would make chinese good so competitive that most US allies’ manufacturing bases would collapse. The morale – it is not ease to wage a trade war against china, even if you can wave ancient documents in your favour!

China was made to honor the messed up boxer rebeliion debts which was extortion just for wanting own soverignty.

That silver would have easily paid for the railroad a hundred times over.

If china pays it then the west should pay back 20 trillion in relative boxer rebellion debt plus opium damages.

They are unwilling to pay 20 trillion. Why should china give america 1 trillion. And it was a century ago made by a manipulated via gunboat policy, west puppet qing empire near its collapse that did not represent the people. But was selling the country out to western companies which was the original reason behind the boxer rebellion in the first place.